Welcome to another biweekly update on all things quantum computing. This week, we look at new talks between Washington and key quantum firms, Google’s latest research leap, fresh funding in quantum hardware, and how Israel plans to ease traffic with quantum power. Let’s go.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

U.S. May Take Stakes in Quantum Firms

The U.S. government is reportedly in talks with IonQ (IONQ), Rigetti Computing (RGTI), and D-Wave Quantum (QBTS) about taking small equity stakes in exchange for at least $10 million in federal funding per company. The plan, first reported by Reuters, is said to be led by the Commerce Department’s CHIPS Research and Development Office.

If approved, it would mark a shift in how the U.S. funds advanced tech. Instead of only offering grants, the government would own part of these companies. Officials see it as a way to secure national leadership in quantum computing, a field that could one day speed up drug discovery, encryption, and AI.

For now, the talks are not confirmed. A Commerce official said no deals are in place, but the idea alone boosted investor mood. Quantum stocks jumped after the reports, with Rigetti exceeding a 9% rise in pre-market trading, D-Wave up 12%, and IonQ up 12%. This comes after all three companies suffered steep declines on Tuesday.

The move could reshape how public and private funds mix in tech. Yet it also raises questions about oversight and what kind of influence Washington might have if it becomes a shareholder.

Google’s 13,000× Quantum Speedup

Alphabet (GOOGL) (GOOG) announced that its quantum unit, Google Quantum AI, ran a physics simulation 13,000 times faster than the world’s top classical supercomputer.

The work, published in Nature, used Google’s 65-qubit “Willow” chip and a new algorithm called Quantum Echoes.

In simple terms, the experiment showed how quantum information moves and mixes at a scale that classical computers cannot match. The result shows a measurable step toward what researchers call “practical quantum advantage” – a point where quantum machines solve useful problems faster than classical ones.

Google says the same technique could improve nuclear magnetic resonance tests, which are used in chemistry and drug design. The team also said this marks its first “software milestone” on its six-step roadmap toward usable quantum systems.

Israel Turns to Quantum for Traffic Flow

In Israel, Ayalon Highways and Quantum Art have joined forces to use quantum computing to manage citywide traffic. The project aims to cut travel time by coordinating hundreds of traffic lights in real time.

Quantum Art’s hardware uses trapped-ion chips that handle many variables at once. The plan is to compare quantum results with current traffic control tools. Over time, the system could extend to public transport, emissions tracking, and logistics.

Officials say even small gains in timing can save drivers hours each week and lower fuel costs. The test marks one of the first real-world trials of quantum computing for urban systems.

SEALSQ Raises $200 Million for Quantum-Safe Chips

Lastly, SEALSQ Corp (LAES) has priced a $200 million equity offering led by Heights Capital Management and Maxim Group. The funds will support its push into post-quantum security chips and expand production in the U.S.

The company recently integrated its French unit, IC’Alps, to create a full design pipeline for custom integrated circuits. The roadmap includes new PQC-standard chips, custom quantum-resistant ASICs, and secure modules for future connected devices. CEO Carlos Moreira said SEALSQ expects a cash position of about $400 million after the offering, which will help speed its next prototype due in 2026.

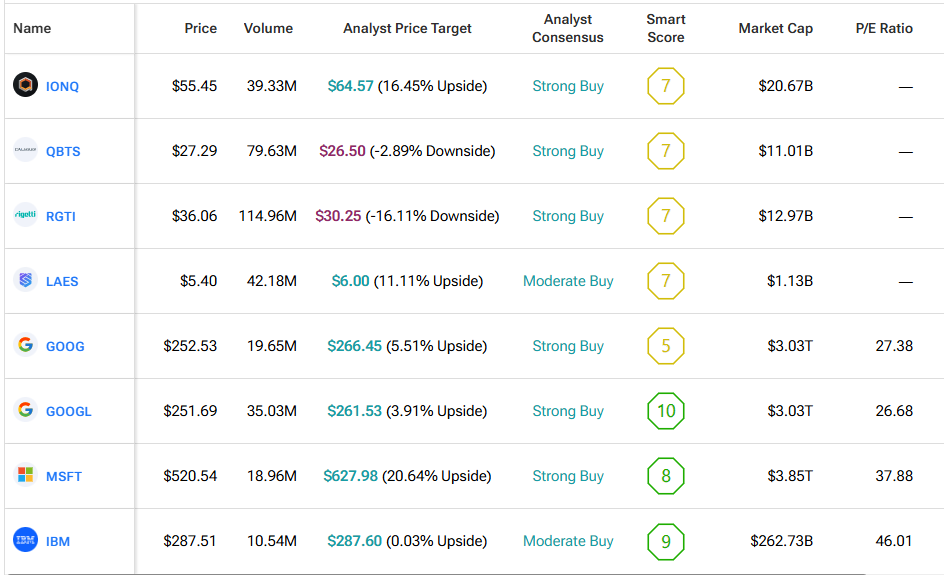

We used TipRanks’ Comparison Tool to line up leading quantum stocks mentioned in this piece. It’s a quick way to see how they stack up and where the field could be heading.