Healthcare stock OraSure Therapeutics (NASDAQ:OSUR) had a great day in Friday afternoon’s trading. The stock was up over 32% of its value today thanks to a very positive second quarter earnings report, and some equally positive guidance around the third quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The basic numbers for OraSure’s quarter came in nicely enough for anyone’s taste. While analysts were expecting no earnings to speak of, OraSure came in with a beat to infinity, going from no earnings projected to $0.09 per share realized. Better yet, OraSure also beat on revenue; while analysts looked for $63.88 million, OraSure knocked that out of the park as well and came in with $85.44 million. That not only beat analysts’ expectations into a cocked hat, but also improved on last year’s figures by 6.5%.

But better yet, OraSure also offered up some great numbers in terms of its forward outlook. While analyst consensus looked for OraSure’s home diagnostics and specimen collection to produce revenue of $48.91 million, OraSure itself looks for between $72 million and $77 million. It looks for its at-home COVID-19 test, known as InteliSwab, to produce about half of that between $35 million and $38 million. And, perhaps best of all, OraSure is on track toward full-term profitability; it looks for cash flow break-even to come into play by the end of 2024.

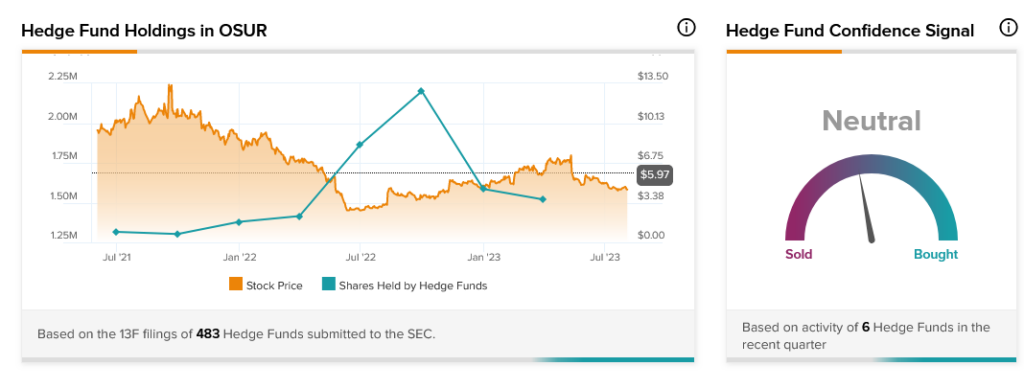

However, hedge funds are less sure about OraSure’s overall performance going forward. In fact, hedge funds reduced their holdings in OraSure by 65,400 shares last quarter, which pitched overall confidence to the lower side of Neutral. Perhaps worse yet is that hedge funds sold shares in OraSure in the last two quarters so far.