U.S.-based semiconductor company Qualcomm (QCOM) is moving deeper into the AI space, and analysts are paying attention. With new next-generation AI chips and fresh partnerships, Bernstein’s five-star-rated analyst Stacy Rasgon believes the company could become a strong player in the fast-growing AI market. Following the announcements yesterday, QCOM stock gained 11.09% and is up another 0.63% in pre-market trading on Tuesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yesterday, Qualcomm announced the launch of new AI chips for the data center market, taking on industry leader Nvidia (NVDA). The company plans to launch two new AI chips, the AI200 and AI250, in 2026 and 2027. It also announced a partnership with Saudi Arabia–backed AI firm Humain, which will deploy 200 megawatts of Qualcomm’s accelerator cards to support the country’s growing AI ambitions.

Bernstein Stays Bullish on QCOM

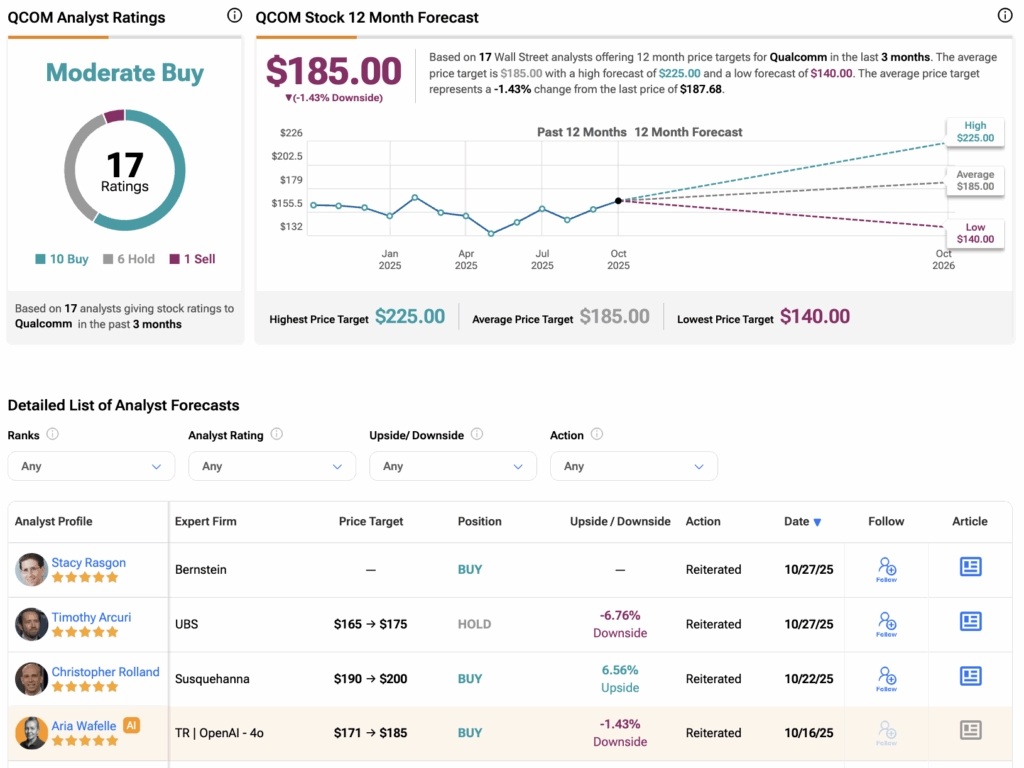

Yesterday, Rasgon reiterated his Buy rating on QCOM stock with a price target of $185.

Rasgon points out that Qualcomm has been selling AI accelerators for years. However, its new data center AI products and the partnership with Saudi Arabia’s Humain to deploy AI racks are gaining much more attention. The news helped Qualcomm’s stock climb strongly, even on an already positive day for the market. Rasgon added that it is reasonable for investors to start giving Qualcomm some credit for capturing even a small piece of the fast-growing AI market.

Additionally, he believes Qualcomm has a better chance to grow in inference-focused AI chips, since there is more space for multiple companies to succeed there compared to the training market, which is currently dominated by Nvidia.

For context, training chips are used to teach AI models and require very powerful and expensive hardware. On the other hand, inference chips are used after training, when the AI runs and gives results. These chips need to be fast, efficient, and cheaper to deploy at scale.

Is Qualcomm a Good Stock to Buy Now?

According to TipRanks, QCOM stock has received a Moderate Buy consensus rating, with 10 Buys, six Holds, and one Sell assigned in the last three months. The average Qualcomm stock price target is $185.0, suggesting a downside of 1.43% from the current level.