American chip designer Qualcomm (QCOM) could generate up to $2 billion in revenue from its new AI chip deployment arrangement with Saudi Arabia’s AI firm, Humain. This is according to an estimate from Wells Fargo’s (WFC) five-star analyst Aaron Rakers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On Monday, the chipmaker, renowned for its Snapdragon processors for mobile phones, grabbed investors’ attention after revealing plans to launch two new AI inference chips, AI200 and AI250, next year. QCOM shares accelerated on the update, surging by more than 12% as of 2:48 p.m. EDT.

Humain to Deploy 200MW of Qualcomm’s Chips

Under the plan, Humain, which is backed by Saudi Arabia’s sovereign wealth fund to champion the kingdom’s AI efforts, will deploy 200 megawatts of Qualcomm’s accelerator cards and racks — special computer cards and cabinet setups powered by those cards — based on the new AI chips. The deployment will deliver AI model inference services in the Middle East and globally.

The deal follows an earlier arrangement between the two countries and will see Humain’s AI models integrated with Qualcomm’s platforms. It comes as Humain continues to expand its AI investment portfolio, having previously entered into partnerships with U.S. chipmakers such as Nvidia (NVDA) and Advanced Micro Devices (AMD), as well as AI networking infrastructure provider Cisco (CSCO).

Chipmakers Race for Superior AI Data Center Chips

According to Rakers, Qualcomm’s focus on manufacturing rack-scale chips for data centers is a “surprise,” given that industry rivalry for AI chips continues to intensify. This month, Intel (INTC) disclosed plans to start testing its Crescent Island graphics processing unit (GPU), while Advanced Micro Devices expanded the Instinct MI series and provided a glimpse into its upcoming rack-scale AI platform Helios. Nvidia also recently unveiled its forthcoming Rubin CPX GPU.

On his part, Bernstein analyst Stacy Rasgon noted that it was “not unreasonable” for Qualcomm to begin to share some of the benefits others have enjoyed amid the AI boom. However, Wells Fargo’s Rakers gave QCOM an Underweight rating, with a price target of $140.

Is QCOM a Good Buy Now?

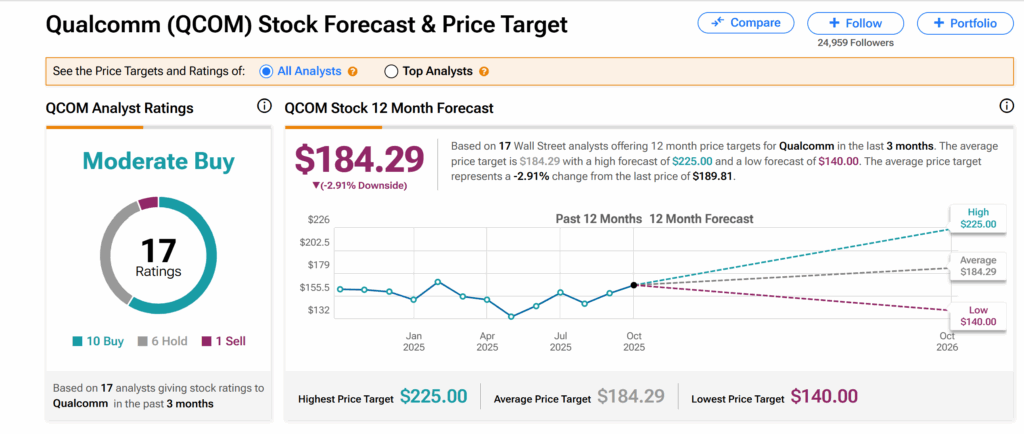

Turning to Wall Street, Qualcomm’s shares currently have a Moderate Buy consensus rating, based on 10 Buys, six Holds, and one Sell ratings from analysts over the past 3 months, as seen on TipRanks. Moreover, the average QCOM price target of $184.29 indicates about 3% downside risk from the current level.