Shares in U.S. chip giant Qualcomm (QCOM) were flat today after it was taken to court by a U.K. consumer campaign group over high smartphone prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Handset Competition

The case brought by Which? against Qualcomm begins today at the Competition Appeal Tribunal in London. It could result in nearly 30 million Brits receiving compensation.

The consumer group claims Qualcomm forced customers Apple (AAPL) and Samsung (SSNLF) to pay inflated prices and licensing fees for essential handset components, which then pushed up the cost of those smartphones for consumers.

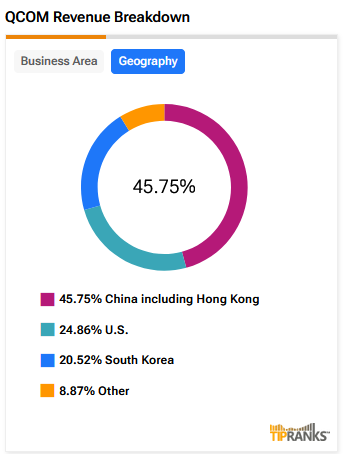

Although the U.K. is a small part of Qualcomm’s overall business, the case could mean it suffers a reputational and financial blow.

It means that Brits who bought an Apple or Samsung smartphone between 2015 and 2024 could share compensation of around £480 million. This would work out at around £17 for each handset bought.

The trial will initially focus on whether Qualcomm held market power and, if so, whether it abused a dominant position. If Which? is successful then a second stage will begin seeking compensation.

But consumers have been warned that it could be years until this second stage concludes.

Held to Account

“We filed this claim back in 2021, so this first trial being now in 2025 – it’s obviously a bit of a slog,” senior Which? lawyer Lisa Webb told the BBC. “But the real benefit of this system is that as a consumer, you don’t need to do anything. If we win, we will get you your money.”

Anabel Hoult, chief executive of Which?, added: “This trial is a huge moment. It shows how the power of consumers – backed by Which? – can be used to hold the biggest companies to account if they abuse their dominant position.”

Qualcomm has previously said that the case has “no basis.”

However, it is facing a similar antitrust class action in British Columbia, Canada, over price-fixing and supply restriction allegations.

Qualcomm is also gearing up for a major shift as its multi-billion-dollar modem chip deal with Apple nears expiration. It is likely that Apple will move its modem production in-house.

Is QCOM a Good Stock to Buy Now?

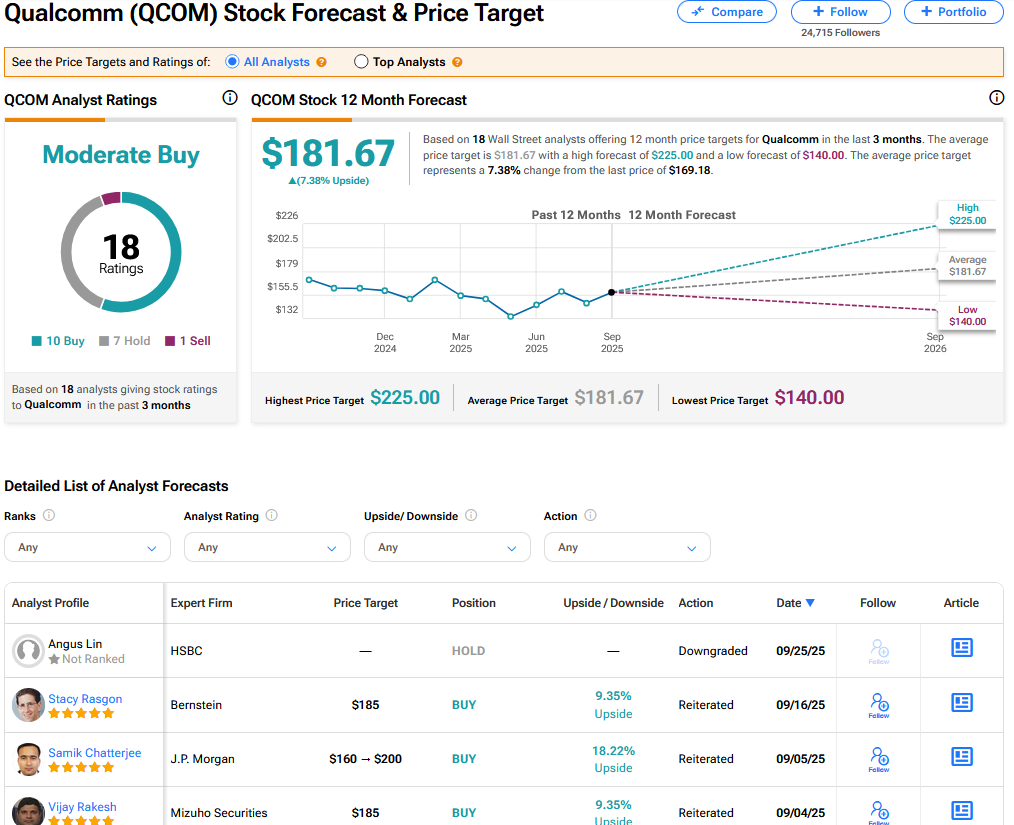

On TipRanks, QCOM has a Moderate Buy consensus based on 10 Buy, 7 Hold and 1 Sell ratings. Its highest price target is $225. QCOM stock’s consensus price target is $181.67, implying a 7.38% upside.