Things weren’t looking good for Qualcomm (NASDAQ:QCOM) for a while there, especially after Qualcomm posted earnings that left investors visibly concerned. Now, however, Qualcomm is making a comeback, up around 2% in Friday afternoon’s trading thanks to new technical developments that will leave it in a position to take on Arm.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

We know that Arm has been pursuing some new technological developments of its own, enough to drive an IPO that might ultimately value the company at around $60 billion. With that kind of valuation, there must be quite a market involved. And that led Qualcomm—along with NXP Semiconductor (NASDAQ:NXPI) and a coalition of other developers—to get in on the action. Now, the group is working to promoted RISC-V architecture, offering an alternative to what Arm is developing and trying to base an 11-figure IPO around. Arm has already made significant inroads in mobile technology, but RISC-V, with an open-source instruction set, could be enough to step in and reduce Arm’s market.

This is news that comes at a great time for Qualcomm. Back on Wednesday—just after market close—Qualcomm brought out its mixed-bag earnings report that featured a narrow win on earnings per share, but a loss on revenue. That, coupled with weak guidance going forward, led to analysts questioning whether or not Qualcomm itself could keep standing. With this latest development, however, Qualcomm might just have exactly what it needs to recover for good.

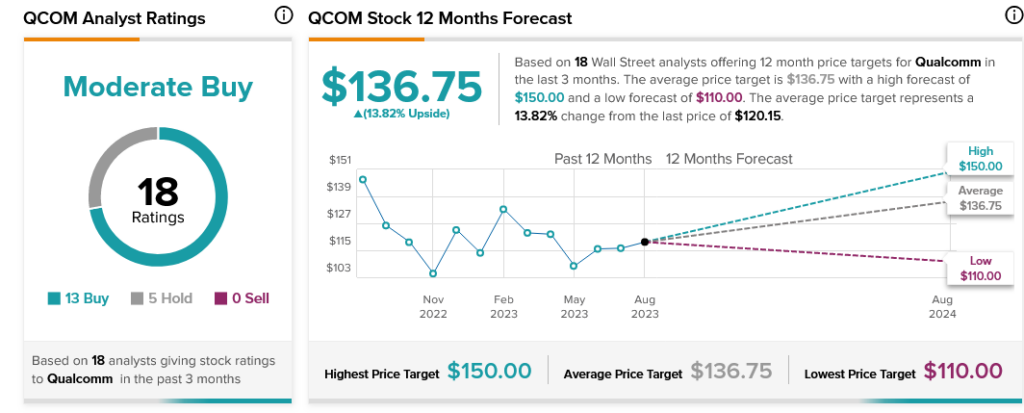

Analysts are still giving Qualcomm the benefit of the doubt, meanwhile. With 13 Buy ratings and five Hold, Qualcomm stock still qualifies as a Moderate Buy. Further, Qualcomm stock comes with a 13.82% upside potential thanks to its average price target of $136.75.