Qualcomm Inc.’s (QCOM) investment arm will acquire a 0.15% stake in Reliance Industries’ digital unit Jio Platforms for 7.3 billion rupees ($97.1 million).

The world’s largest mobile chipmaker said the investment will strengthen the ties between Qualcomm and Jio Platforms, and help the latter in the rollout of its advanced 5G infrastructure and services for Indian customers.

Jio Platforms, a majority-owned subsidiary of Reliance Industries, is a next-generation technology platform focused on providing affordable digital services across India, and has more than 388 million subscribers.

“With unmatched speeds and emerging use cases, 5G is expected to transform every industry in the coming years. Jio Platforms has led the digital revolution in India through its extensive digital and technological capabilities,” Qualcomm CEO Steve Mollenkopf said. “As an enabler and investor with a longstanding presence in India, we look forward to playing a role in Jio’s vision to further revolutionize India’s digital economy.”

Qualcomm Ventures is a global fund that invests in pioneering companies across the wireless ecosystem in areas like 5G, AI, IoT, automotive, networking and enterprise. In India, Qualcomm Ventures has invested in companies that address key domestic needs from dairy, transportation to defense.

Large corporates, including Silverlake and Facebook (FB) have in recent months invested in India’s Jio taking the total invested to over $10 billion.

Shares in Qualcomm have recouped all of this year’s earlier losses and are now up 4.9% year-to-date trading at $92.51 as of Friday’s close.

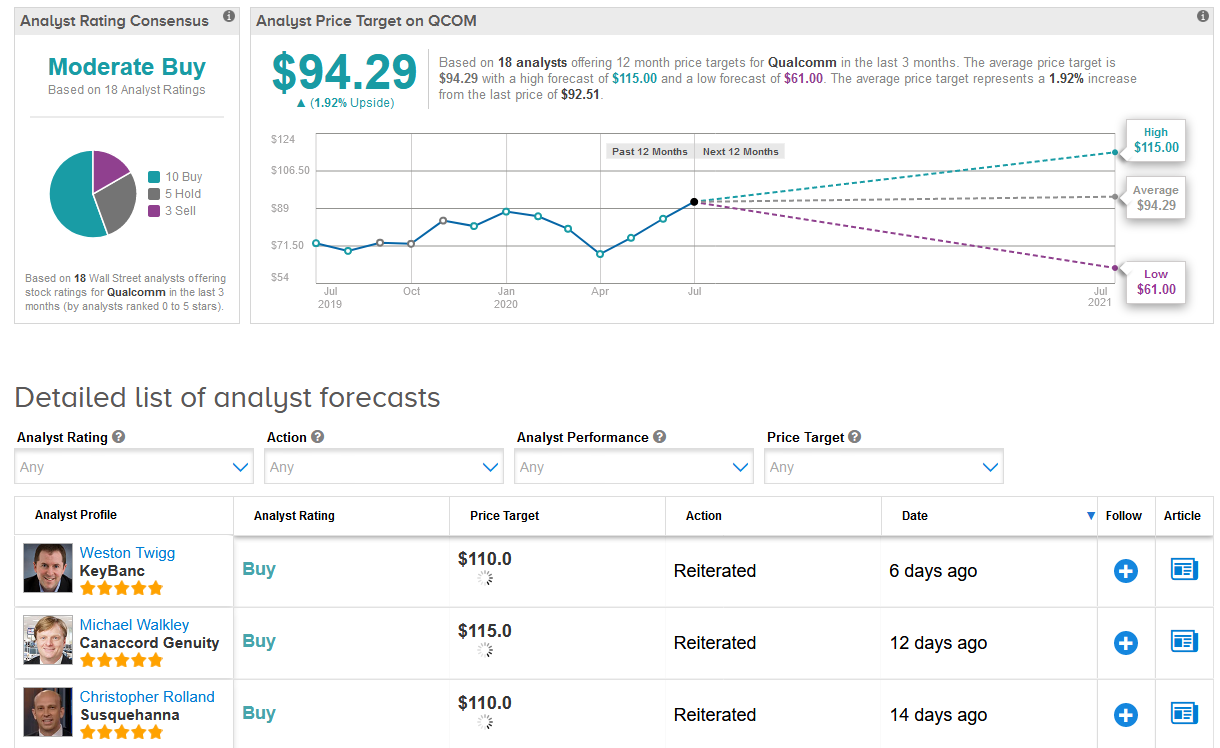

Susquehanna analyst Christopher Rolland recently raised Qualcomm’s price target to $110 (19% upside potential) from $105, and maintained a Buy rating on the stock, amid expectations that the mobile chipmaker will benefit from Apple’s (AAPL) forthcoming 5G iPhones.

“Qualcomm has defined the cutting-edge cellular standard by consistently ‘moving the goal posts’ in baseband capabilities for the last two decades. Every time a competitor matches Qualcomm’s technology, they quickly add important new ‘table-stakes’ features,” Rolland wrote in a note to investors.

The rest of the Street is cautiously optimistic on the shares with an analyst consensus of Moderate Buy, based on 10 Buys, 5 Holds and 3 Sells. With an average price target of $94.29, analysts see the stock as almost fully priced. (See Qualcomm stock analysis on TipRanks)

Related News:

Analog Devices Is Said To Be In Talks To Snap Up Maxim For About $20B

Apple Is Developing Its Own Graphics Cards- Report

Has Apple Surged Too Far, Too Fast? Analyst Weighs In