Shares of QCR Holdings (QCRH) gained 1.3% to close at $47.85 on May 24 after the bank announced the reinstatement of its stock repurchase program, which was initially authorized in February 2020.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Due to the COVID-19 pandemic, share repurchases were suspended by the company on March 16, 2020. Under the previously authorized program, 699,068 shares remained for repurchase.

QCR Holdings CEO Larry J. Helling said, “We continue to deliver strong financial performance, and reinstating this program gives us the opportunity to buy back shares and build long-term value.” (See QCR Holdings stock analysis on TipRanks)

Last month, QCR Holdings reported Q1 results. Adjusted earnings climbed 50.6% year-over-year to $1.16 per share and outpaced Street estimates of $1.12. Adjusted net interest income increased 12.3% to $43.7 million, while adjusted net interest margin declined 10 basis points to 3.40%.

On April 28, Raymond James analyst Daniel Cardenas increased the stock’s price target to $55 (15% upside potential) from $46 and reiterated a Buy rating following the company’s Q1 earnings report.

Cardenas said, “QCR is well positioned for post-pandemic life and expect the bank to produce superior growth driven by continued market share gains. With the stock trading at a discount to peers on a P/E basis, we believe this is an attractive entry point.”

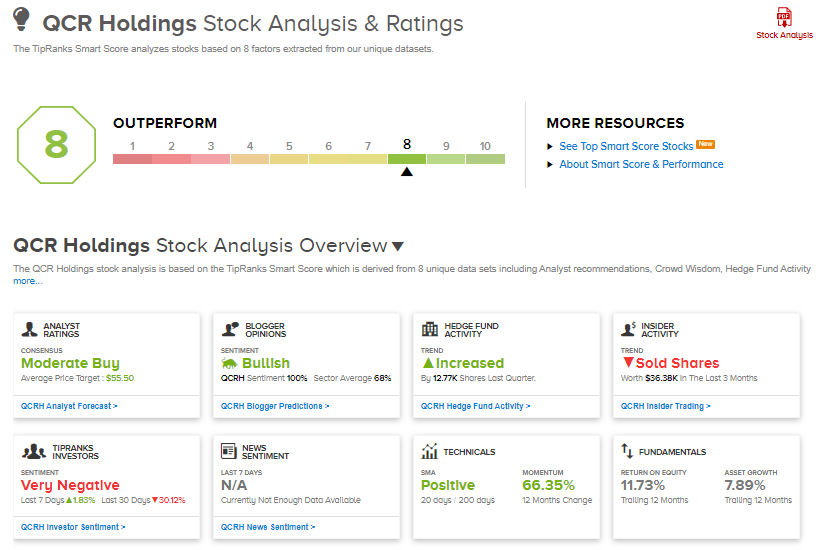

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 2 Buys. The average analyst price target of $55.50 implies 16% upside potential to current levels. Shares have increased 28.7% over the past six months.

Additionally, QCR Holdings scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Cisco’s Q4 Earnings Outlook Miss Estimates After Q3 Beat; Shares Drop After-Hours

Shoe Carnival Posts Quarterly Beat As Sales Improve, Q2 Revenue Outlook Disappoints

Lennox Bumps Up Quarterly Dividend By 19%