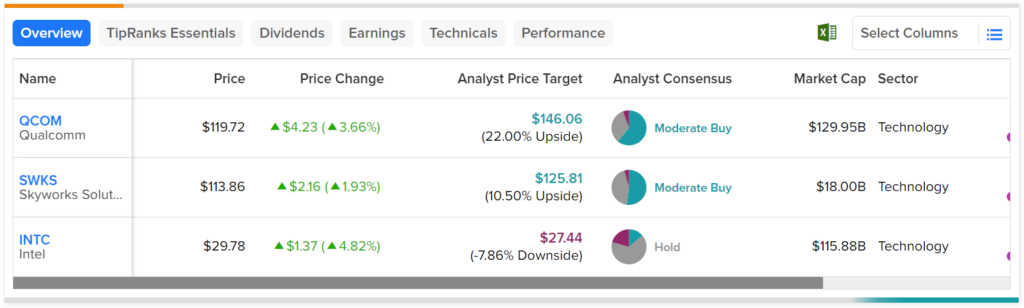

Shares of Qualcomm (NASDAQ:QCOM), Skyworks Solutions (NASDAQ:SWKS), and Intel (NASDAQ:INTC) jumped today, which can be attributed to an analyst upgrade. Christopher Rolland of Susquehanna changed his ratings on QCOM and SWKS from Hold to Buy while bumping INTC from Sell to Hold. In addition, his price targets are $140, $135, and $26 per share, respectively.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Rolland believes that the chip sector has passed the “acute portion of the contraction” and that “inventory levels have normalized.” In addition, demand is showing early signs of improvement. Rolland also included some company-specific catalysts to justify his upgrades.

Qualcomm stands to benefit from the reopening of the Chinese economy along with the move to downmarket smartphones. On the other hand, Skyworks’ catalysts include the unveiling of Wi-Fi 6E technology and a push to have content in more Android phones. Lastly, Intel doesn’t appear to be losing any more market share to AMD (NASDAQ:AMD), as they have provided a better product roadmap.

Overall, Wall Street analysts have consensus price targets of $146.06, $125.81, and $27.44 on QCOM, SWKS, and INTC stocks, respectively. This implies upside potential of 22% and 10.5% for the first two stocks but almost 8% downside potential for INTC, as indicated by the graphic above.