D-Wave Quantum (QBTS) shares dropped 8.5% on November 6, despite reporting a strong third-quarter revenue beat and solid bookings. Investor enthusiasm could have waned due to wider-than-expected losses. Nonetheless, top analysts remain optimistic about the company’s long-term outlook.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

QBTS reported a 100% year-over-year jump in revenue to $3.7 million, beating expectations of $3.03 million. However, its diluted loss of $0.41 missed consensus estimates, was impacted by high non-cash, non-operating warrant remeasurement charges during the quarter.

Five-Star Analysts Remain Bullish on QBTS

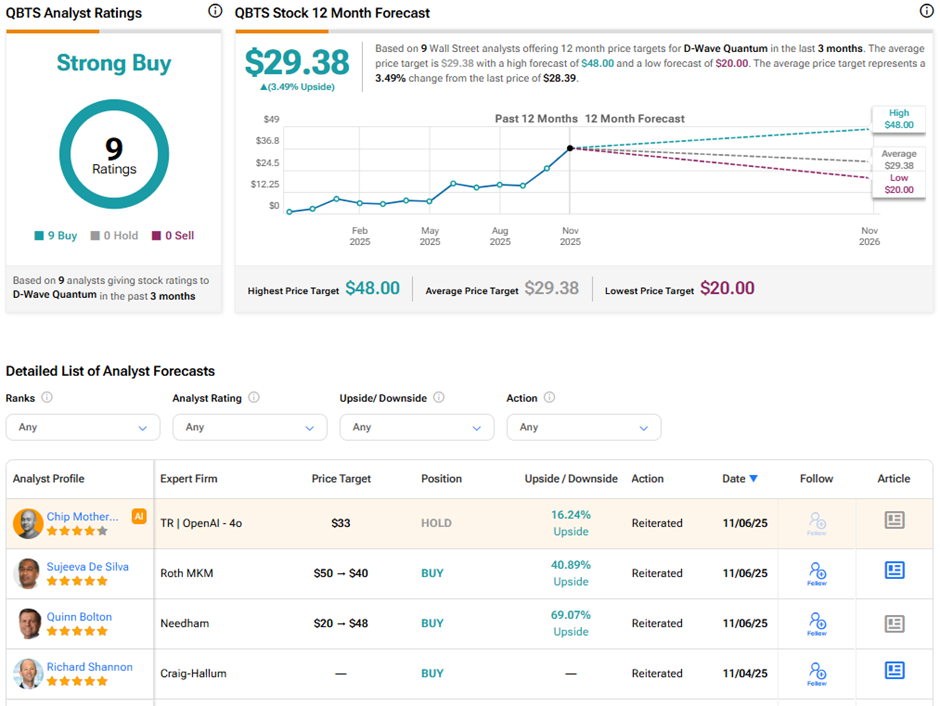

Following the results, Needham analyst Quinn Bolton reiterated his “Buy” rating on QBTS and $48 price target, which implies 69.1% upside potential. Bolton had recently raised his price target from $20 to $48, in anticipation of solid results. Bolton ranks #45 out of 10,109 analysts tracked on TipRanks. He has a 59% success rate and an impressive average return per rating of 37%.

Additionally, Roth MKM analyst Sujeeva De Silva maintained his “Buy” rating, while lowering the price target from $50 to $40, implying nearly 41% upside potential. De Silva ranks #101 and has a 52% success rate, with a 35.10% average return per rating.

Bolton – Customer Engagements Remain Robust

Bolton emphasized that D-Wave continues to experience strong momentum in both new and repeat customer deals across various industries and regions. Key partnerships include a major U.S.-based international airline and Turkey’s Yapi Kredi Bank. He also pointed to progress in developing D-Wave’s gate-model quantum system and the next-generation Advantage3 annealing platform.

He highlighted a five-year, €10 million agreement with Swiss Quantum Technology SA to install an Advantage2 system in Italy, with potential for a later purchase valued between $20–40 million. Bolton added that D-Wave expects at least one system sale annually over the next few years. The company has finished building fluxonium qubit circuits and superconducting control chips for its gate-model system and is finalizing the Advantage3 prototype chip, with testing scheduled to begin this quarter.

De Silva – Pipeline Opportunities Are Expanding

De Silva remains encouraged by D-Wave’s expanding global pipeline opportunities, especially in cloud services and hardware sales, along with increased traction with U.S. government projects. He highlighted that D-Wave’s latest agreement with Swiss Quantum Technology and the adoption of its next-generation Advantage2 platform with 4,400 qubits are promising signs of future demand and growth.

De Silva’s revised target reflects a more cautious but still optimistic outlook, recognizing that the stock’s current market conditions and growth trajectory support a lower but still positive valuation.

Is QBTS Stock a Strong Buy?

Yes, QBTS stock has a Strong Buy consensus rating on TipRanks based on nine unanimous Buy ratings. The average D-Wave Quantum price target of $29.38 implies 3.5% upside potential from current levels. Year-to-date, QBTS stock has surged nearly 238%.