D-Wave Quantum (QBTS) stock is falling in pre-market trading despite beating sales expectations for the third quarter. The quantum computing firm’s sales jumped by 100% year-over-year to $3.7 million, beating the consensus estimates of $3.03 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

D-Wave uses quantum annealing with superconducting qubits optimized for solving specific optimization problems, making its approach different from rivals such as IonQ Inc. (IONQ) and Rigetti Computing (RGTI).

Details of D-Wave Quantum’s Q3 Results

Notably, D-Wave reported a diluted loss of $0.41 per share, higher than the consensus-expected loss of $0.07 per share and the prior year quarter’s loss of $0.11 per share. Meanwhile, adjusted loss stood at $0.05 per share, lower than the prior year period’s loss of $0.12 per share. The higher losses were mainly due to non-cash, non-operating warrant remeasurement related charges.

QBTS ended the quarter with record bookings of $2.4 million, up 80% sequentially. Bookings refer to its pipeline of expected future sales. It is worth noting that following the end of the third quarter, the company has closed additional bookings of more than $12 million. The company also recorded its highest-ever cash balance of more than $836 million.

Future Roadmap

The company did not issue any guidance for the fourth quarter of full year.

Nonetheless, D-Wave announced a €10 million fourth-quarter 2025 booking for 50% of the capacity of its Advantage2 annealing quantum computer to help create a major quantum research center in Lombardy, Italy. In partnership with the Italian government and the Q-Alliance, the deal includes five years of access with an option to buy the full system.

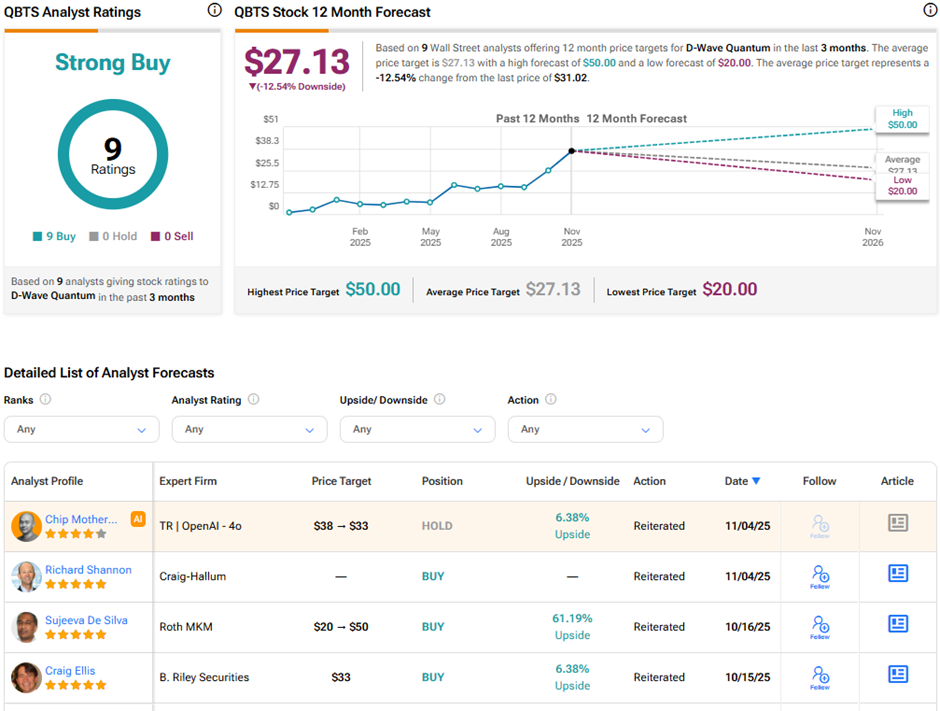

Is QBTS Stock a Buy, Hold, or Sell?

On TipRanks, QBTS stock has a Strong Buy consensus rating based on nine unanimous Buy ratings. The average D-Wave Quantum price target of $27.13 implies 12.5% downside potential from current levels. Year-to-date, QBTS stock has surged over 269%.

Please note these ratings were issued before the Q3 print and are subject to change once analysts review the results.