Coinbase (NASDAQ:COIN) projects a bullish Q2 2024 for Bitcoin (BTC-USD), attributing the optimism to the increasing interest from large institutions in spot Bitcoin exchange-traded funds (ETFs). This anticipation stems from a recent analysis by Coinbase’s head of institutional research, David Duong, who highlighted a shift in market dynamics and the significant milestones ahead for cryptocurrency.

Duong’s identified the upcoming Bitcoin halving event, coupled with institutional investment in Bitcoin ETFs, as primary reasons to expect an upswing in BTC prices. Duong forecasts that the impact of these factors will become particularly evident from the second half of April 2024 onward, setting the stage for a quarter marked by robust performance in the crypto sector.

More Big Institutional Names Incoming?

Another catalyst theorized to improve Bitcoin’s price performance is the conclusion of the 90-day review period, which large institutions use to evaluate new financial products like spot Bitcoin ETFs. Duong points to April 10th as a critical date when institutions such as Morgan Stanley (NYSE:MS), Bank of America (NYSE:BAC), UBS Group AG (NYSE:UBS), and Goldman Sachs (NYSE:GS) may begin offering Bitcoin ETFs to their clients.

Similarly, BlackRock (NYSE:BLK) CEO Larry Fink has again expressed a bullish stance on Bitcoin, following the remarkable success of BlackRock’s spot Bitcoin ETF, IBIT. With over 250,000 BTC now under its belt and a record-setting pace of growth, IBIT has become the clear leader in the BTC ETF space. IBIT’s performance has surpassed expectations and highlighted the critical role ETFs play in enhancing market liquidity and transparency.

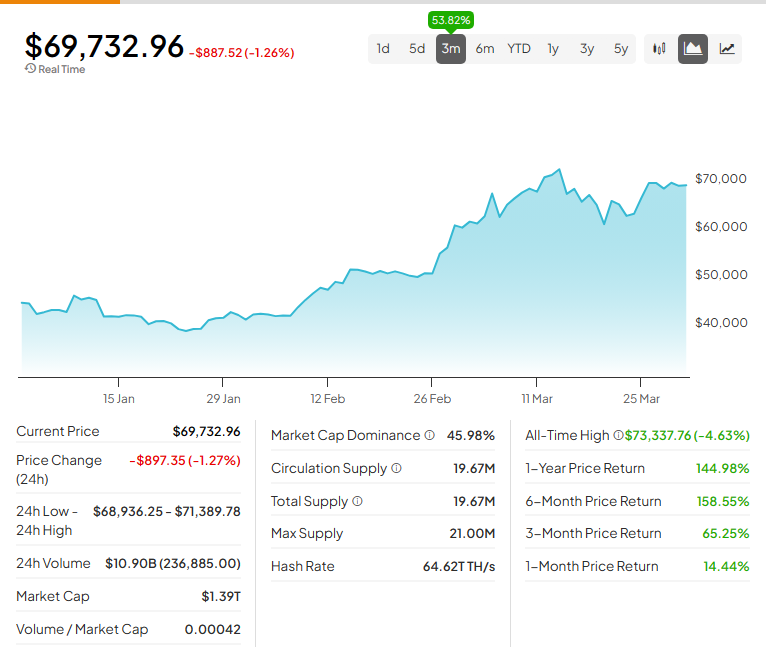

Bitcoin Holding Near $79k

Bitcoin avoided much of the weekend volatility that the crypto market usually experiences. From a technical analysis perspective, Bitcoin remains stuck in congestion zone between $71k and $69k, with neither bulls nor bears able to make a convincing push out the current seven day range.

Don’t let crypto give you a run for your money. Track coin prices here