Real estate investment trust, Prologis (NYSE: PLD) announced on Monday that it will acquire around 14 million square feet of industrial properties from real estate funds affiliated with Blackstone (BX) for $3.1 billion in cash. The company stated in its press release that this “acquisition price represents around a 4% cap rate in the first year and a 5.75% cap rate when adjusting to today’s market rents.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The acquisition is expected to close by the end of the second quarter. Dan Letter, President, Prologis commented, “These high-quality properties are complementary to our portfolio and fit perfectly into our long-term strategic plan for growth. The acquisition demonstrates our unique ability to add significant scale to our portfolio – expanding customer relationships and increasing opportunities for our growing Essentials platform.”

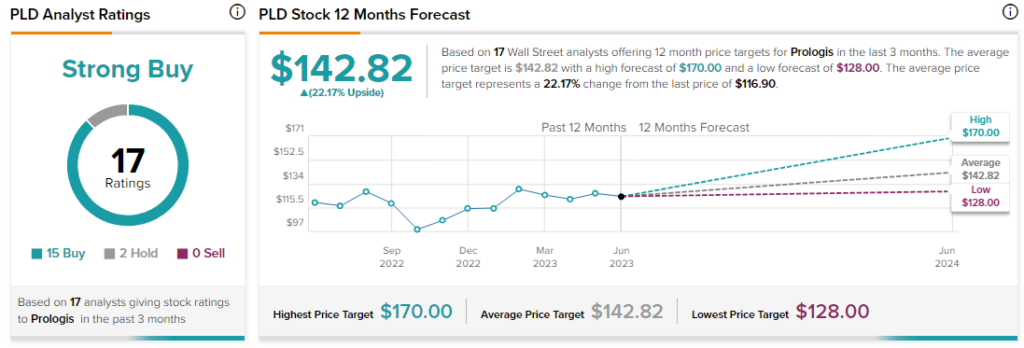

Analysts are bullish about PLD stock with a Strong Buy consensus rating based on 15 Buys and two Holds.