Prologis said it expects 2020 EPS in the range of $2.20-$2.24, surpassing the Street consensus of $1.78. The real estate investment trust also forecasts core FFO in the range of $3.76-$3.78 per share for 2020. Analysts’ estimates stood at $3.72.

In addition, Prologis (PLD) reported 3Q EPS of $0.40 which exceeded analysts’ estimate of $0.32. Revenues of $1.08 billion also came ahead of the consensus estimates of $955.8 million. The company’s core funds from operations (FFO) of $0.90 per share also beat the Street estimates of $0.88.

Prologis CEO Hamid R. Moghadam said “Activity in our portfolio is robust and broadening – a reflection of increased demand in the quarter across multiple sectors, the adoption of e-commerce and the need for higher levels of inventory.” The company’s CFO Thomas S. Olinger said “Our outlook continues to improve based on results, leasing and lower credit losses.” (See PLD stock analysis on TipRanks).

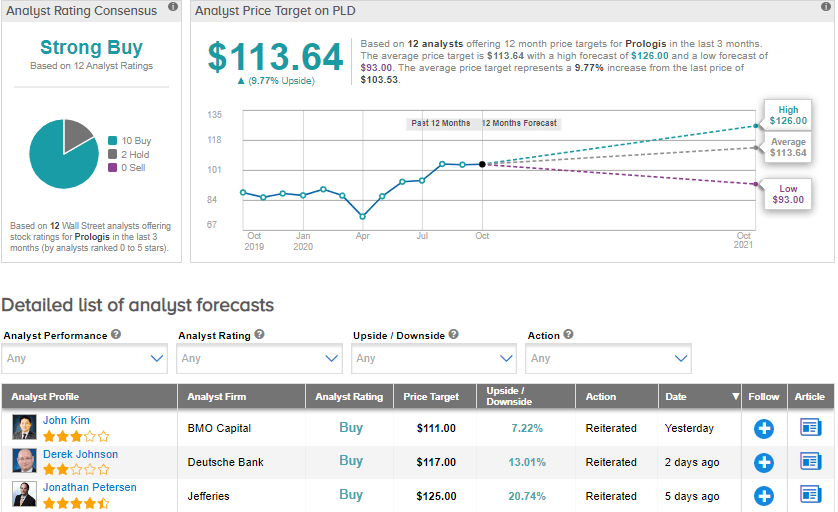

Following the results, BMO Capital analyst John Kim said that Prologis delivered stellar results adding that he believes that the stock has more upside potential. He maintained a Buy rating on the stock with a price target of $111 (7.2% upside potential).

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 10 Buys and 2 Holds. The average price target of $113.64 implies upside potential of about 9.8% to current levels. Shares are up by 16.1% year-to-date.

Related News:

Procter & Gamble Raises 2021 Outlook As 1Q Sales Surge 9%

Philip Morris Slips 6% As 4Q Profit Outlook Misses Estimates

Pinnacle’s Profit Beats Estimates; Street Sees 21% Upside