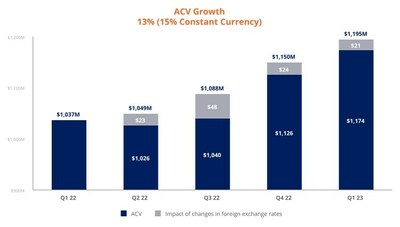

- Annual contract value (ACV) grows 15% year over year (constant currency)

- Focus on profitable growth leads to significant cash generation

- Pega Cloud gross margin reaches 72%

CAMBRIDGE, Mass., April 26, 2023 /PRNewswire/ — Pegasystems Inc., the low-code platform provider empowering the world’s leading enterprises to Build for Change®, released its financial results for the first quarter of 2023.

“I’m pleased with our strong start to the year and progress against our 2023 goals,” said Alan Trefler, Pega founder and CEO. “Our commitment to deep client engagement is perfectly suited to our clients and the times, and we continue to see tremendous opportunity for growth.”

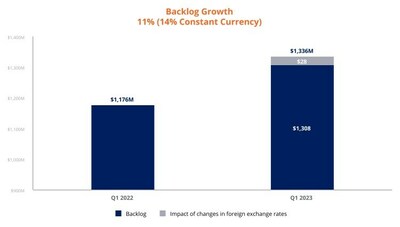

“Our team delivered well on our three most important financial metrics of ACV growth, free cash flow, and backlog,” said Ken Stillwell, Pega COO and CFO. “There’s great excitement throughout our team on our journey to becoming a Rule of 40 company.”

|

Financial and performance metrics (1) |

|||||

|

(Dollars in thousands, except per share amounts) |

Three Months Ended March 31, |

||||

|

2023 |

2022 |

Change |

|||

|

Total revenue |

$ 325,472 |

$ 376,307 |

(14) % |

||

|

Net (loss) – GAAP |

$ (20,774) |

$ (379) |

* |

||

|

Net income – non-GAAP |

$ 19,220 |

$ 50,174 |

(62) % |

||

|

Diluted (loss) per share – GAAP |

$ (0.25) |

$ 0.00 |

* |

||

|

Diluted earnings per share – non-GAAP |

$ 0.23 |

$ 0.59 |

(61) % |

||

* not meaningful

|

(Dollars in thousands) |

Three Months Ended March 31, |

Change |

||||||

|

2023 |

2022 |

|||||||

|

Pega Cloud |

$ 107,879 |

33 % |

$ 90,317 |

24 % |

$ 17,562 |

19 % |

||

|

Maintenance |

79,630 |

25 % |

79,716 |

21 % |

(86) |

— % |

||

|

Subscription services |

187,509 |

58 % |

170,033 |

45 % |

17,476 |

10 % |

||

|

Subscription license |

84,527 |

26 % |

137,533 |

37 % |

(53,006) |

(39) % |

||

|

Subscription |

272,036 |

84 % |

307,566 |

82 % |

(35,530) |

(12) % |

||

|

Perpetual license |

403 |

— % |

7,440 |

2 % |

(7,037) |

(95) % |

||

|

Consulting |

53,033 |

16 % |

61,301 |

16 % |

(8,268) |

(13) % |

||

|

$ 325,472 |

100 % |

$ 376,307 |

100 % |

$ (50,835) |

(14) % |

|||

|

(1) See the schedules at the end of this release for additional information, including a reconciliation of our GAAP to non-GAAP measures. |

|

Note: Constant currency ACV and Backlog are calculated by applying the Q1 2022 foreign exchange rates to all periods shown. |

Quarterly conference call

A conference call and audio-only webcast will be conducted at 5:00 p.m. EDT on Wednesday, April 26, 2023. Members of the public and investors are invited to join the call and participate in the question and answer session by dialing 1-877-407-9039 (domestic), 1-201-689-8470 (international), or via webcast (https://viavid.webcasts.com/starthere.jsp?ei=1606804&tp_key=1167d38249) by logging onto pega.com at least five minutes prior to the event’s broadcast and clicking on the webcast icon in the Investors section.

Discussion of non-GAAP financial measures

We believe that non-GAAP financial measures help investors understand our core operating results and prospects, consistent with how management measures and forecasts our performance without the effect of often one-time charges and other items outside our normal operations. The supplementary non-GAAP financial measures are not meant to be superior to or a substitute for financial measures prepared under U.S. GAAP.

Reconciliations of our non-GAAP and GAAP measures are at the end of this release.

Forward-looking statements

Certain statements in this press release may be “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995.

Words such as expects, anticipates, intends, plans, believes, will, could, should, estimates, may, targets, strategies, projects, forecasts, guidance, likely, and usually, or variations of such words and other similar expressions identify forward-looking statements, which are based on current expectations and assumptions.

Forward-looking statements deal with future events and are subject to risks and uncertainties that are difficult to predict, including, but not limited to:

- our future financial performance and business plans;

- the adequacy of our liquidity and capital resources;

- the continued payment of our quarterly dividends;

- the timing of revenue recognition;

- management of our transition to a more subscription-based business model;

- variation in demand for our products and services, including among clients in the public sector;

- reliance on key personnel;

- global economic and political conditions and uncertainty, including impacts from public health emergencies and the war in Ukraine;

- reliance on third-party service providers, including hosting providers;

- compliance with our debt obligations and covenants;

- the potential impact of our convertible senior notes and Capped Call Transactions;

- foreign currency exchange rates;

- the potential legal and financial liabilities and damage to our reputation due to cyber-attacks;

- security breaches and security flaws;

- our ability to protect our intellectual property rights, costs associated with defending such rights, intellectual property rights claims, and other related claims by third parties against us, including related costs, damages, and other relief that may be granted against us;

- our ongoing litigation with Appian Corp.;

- our client retention rate; and

- management of our growth.

These risks and others that may cause actual results to differ materially from those expressed in such forward-looking statements are described further in Part I of our Annual Report on Form 10-K for the year ended December 31, 2022, and other filings we make with the U.S. Securities and Exchange Commission (“SEC”).

Except as required by applicable law, we do not undertake and expressly disclaim any obligation to update or revise these forward-looking statements publicly, whether due to new information, future events, or otherwise.

The forward-looking statements in this press release represent our views as of April 26, 2023.

About Pegasystems

Pega provides a powerful low-code platform that empowers the world’s leading enterprises to Build for Change®. Clients use our AI-powered decisioning and workflow automation to solve their most pressing business challenges – from personalizing engagement to automating service to streamlining operations. Since 1983, we’ve built our scalable and flexible architecture to help enterprises meet today’s customer demands while continuously transforming for tomorrow. For more information on Pegasystems (NASDAQ: PEGA), visit https://www.pega.com

Press contact:

Lisa Pintchman

VP, Corporate Communications

lisapintchman.rogers@pega.com

617-866-6022

Twitter: @pega

Investor contact:

Peter Welburn

VP, Corporate Development & Investor Relations

PegaInvestorRelations@pega.com

617-498-8968

All trademarks are the property of their respective owners.

|

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share amounts) |

|||

|

Three Months Ended March 31, |

|||

|

2023 |

2022 |

||

|

Revenue |

|||

|

Subscription services |

$ 187,509 |

$ 170,033 |

|

|

Subscription license |

84,527 |

137,533 |

|

|

Consulting |

53,033 |

61,301 |

|

|

Perpetual license |

403 |

7,440 |

|

|

Total revenue |

325,472 |

376,307 |

|

|

Cost of revenue |

|||

|

Subscription services |

36,864 |

32,030 |

|

|

Subscription license |

719 |

622 |

|

|

Consulting |

60,348 |

55,511 |

|

|

Perpetual license |

3 |

34 |

|

|

Total cost of revenue |

97,934 |

88,197 |

|

|

Gross profit |

227,538 |

288,110 |

|

|

Operating expenses |

|||

|

Selling and marketing |

149,797 |

162,236 |

|

|

Research and development |

75,376 |

71,490 |

|

|

General and administrative |

23,110 |

35,764 |

|

|

Restructuring |

1,461 |

— |

|

|

Total operating expenses |

249,744 |

269,490 |

|

|

(Loss) income from operations |

(22,206) |

18,620 |

|

|

Foreign currency transaction (loss) gain |

(2,675) |

2,876 |

|

|

Interest income |

1,485 |

207 |

|

|

Interest expense |

(1,918) |

(1,946) |

|

|

Gain (loss) on capped call transactions |

3,206 |

(30,560) |

|

|

Other income, net |

6,583 |

2,741 |

|

|

(Loss) before provision for (benefit from) income taxes |

(15,525) |

(8,062) |

|

|

Provision for (benefit from) income taxes |

5,249 |

(7,683) |

|

|

Net (loss) |

$ (20,774) |

$ (379) |

|

|

(Loss) per share |

|||

|

Basic |

$ (0.25) |

$ — |

|

|

Diluted |

$ (0.25) |

$ — |

|

|

Weighted-average number of common shares outstanding |

|||

|

Basic |

82,604 |

81,680 |

|

|

Diluted |

82,604 |

81,680 |

|

|

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) |

|||

|

March 31, 2023 |

December 31, 2022 |

||

|

Assets |

|||

|

Current assets: |

|||

|

Cash and cash equivalents |

$ 168,318 |

$ 145,054 |

|

|

Marketable securities |

155,564 |

152,167 |

|

|

Total cash, cash equivalents, and marketable securities |

323,882 |

297,221 |

|

|

Accounts receivable |

201,585 |

255,150 |

|

|

Unbilled receivables |

196,279 |

213,719 |

|

|

Other current assets |

73,982 |

80,388 |

|

|

Total current assets |

795,728 |

846,478 |

|

|

Unbilled receivables |

79,704 |

95,806 |

|

|

Goodwill |

81,434 |

81,399 |

|

|

Other long-term assets |

324,975 |

333,989 |

|

|

Total assets |

$ 1,281,841 |

$ 1,357,672 |

|

|

Liabilities and stockholders’ equity |

|||

|

Current liabilities: |

|||

|

Accounts payable |

$ 12,565 |

$ 18,195 |

|

|

Accrued expenses |

45,432 |

50,355 |

|

|

Accrued compensation and related expenses |

56,574 |

127,728 |

|

|

Deferred revenue |

342,591 |

325,212 |

|

|

Other current liabilities |

17,802 |

17,450 |

|

|

Total current liabilities |

474,964 |

538,940 |

|

|

Convertible senior notes, net |

561,655 |

593,609 |

|

|

Operating lease liabilities |

76,082 |

79,152 |

|

|

Other long-term liabilities |

14,644 |

15,128 |

|

|

Total liabilities |

1,127,345 |

1,226,829 |

|

|

Total stockholders’ equity |

154,496 |

130,843 |

|

|

Total liabilities and stockholders’ equity |

$ 1,281,841 |

$ 1,357,672 |

|

|

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) |

|||

|

Three Months Ended March 31, |

|||

|

2023 |

2022 |

||

|

Net (loss) |

$ (20,774) |

$ (379) |

|

|

Adjustments to reconcile net (loss) to cash provided by operating activities |

|||

|

Non-cash items |

59,766 |

70,827 |

|

|

Change in operating assets and liabilities, net |

29,115 |

(55,332) |

|

|

Cash provided by operating activities |

68,107 |

15,116 |

|

|

Cash (used in) investing activities |

(14,413) |

(6,082) |

|

|

Cash (used in) financing activities |

(29,372) |

(35,918) |

|

|

Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

782 |

(310) |

|

|

Net increase (decrease) in cash, cash equivalents, and restricted cash |

25,104 |

(27,194) |

|

|

Cash, cash equivalents, and restricted cash, beginning of period |

145,054 |

159,965 |

|

|

Cash, cash equivalents, and restricted cash, end of period |

$ 170,158 |

$ 132,771 |

|

|

PEGASYSTEMS INC. RECONCILIATION OF SELECTED GAAP AND NON-GAAP MEASURES (in thousands, except percentages and per share amounts) |

|||||

|

Three Months Ended March 31, |

|||||

|

2023 |

2022 |

Change |

|||

|

Net (loss) – GAAP |

$ (20,774) |

$ (379) |

* |

||

|

Stock-based compensation (1) |

42,557 |

28,227 |

|||

|

Capped call transactions |

(3,206) |

30,560 |

|||

|

Legal fees |

1,476 |

17,368 |

|||

|

Restructuring |

1,461 |

— |

|||

|

Interest on convertible senior notes |

728 |

719 |

|||

|

Amortization of intangible assets |

1,049 |

972 |

|||

|

Foreign currency transaction loss (gain) |

2,675 |

(2,876) |

|||

|

Other |

(6,574) |

(2,582) |

|||

|

Income tax effects (2) |

(172) |

(21,835) |

|||

|

Net income – non-GAAP |

$ 19,220 |

$ 50,174 |

(62) % |

||

|

Diluted (loss) per share – GAAP |

$ (0.25) |

$ 0.00 |

* |

||

|

non-GAAP adjustments |

0.48 |

0.59 |

|||

|

Diluted earnings per share – non-GAAP |

$ 0.23 |

$ 0.59 |

(61) % |

||

|

Diluted weighted-average number of common shares outstanding – GAAP |

82,604 |

81,680 |

1 % |

||

|

Stock-based compensation |

762 |

2,743 |

|||

|

Diluted weighted-average number of common shares outstanding – non-GAAP |

83,366 |

84,423 |

(1) % |

||

|

* not meaningful |

Our non-GAAP financial measures reflect the following adjustments:

- Stock-based compensation: We have excluded stock-based compensation from our non-GAAP operating expenses and profitability measures. Although stock-based compensation is a key incentive offered to our employees, and we believe such compensation contributed to our revenues recognized during the periods presented and is expected to contribute to our future revenues, we continue to evaluate our business performance, excluding stock-based compensation.

- Capped call transactions: We have excluded gains and losses related to our capped call transactions held at fair value under U.S. GAAP. The capped call transactions are expected to reduce common stock dilution and/or offset any potential cash payments we must make, other than for principal and interest, upon conversion of the Notes. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

- Legal fees: Includes legal and related fees arising from proceedings outside of the ordinary course of business. We believe excluding these expenses from our non-GAAP financial measures is useful to investors as the disputes giving rise to them are not representative of our core business operations and ongoing operational performance.

- Restructuring: We have excluded restructuring from our non-GAAP financial measures. Restructuring fluctuates in amount and frequency and is significantly affected by the timing and size of our restructuring activities. We believe excluding the impact from our non-GAAP financial measures is useful to investors as these amounts are not representative of our core business operations and ongoing operational performance.

- Interest on convertible senior notes: In February 2020, we issued convertible senior notes, due March 1, 2025, in a private placement. We believe excluding the amortization of issuance costs provides a useful comparison of our operational performance in different periods.

- Amortization of intangible assets: We have excluded the amortization of intangible assets from our non-GAAP operating expenses and profitability measures. Amortization of intangible assets fluctuates in amount and frequency and is significantly affected by the timing and size of acquisitions. Investors should note that intangible assets contributed to our revenues recognized during the periods presented and are expected to contribute to future revenues. Amortization of intangible assets is likely to recur in future periods. We believe excluding these amounts provides a useful comparison of our operational performance in different periods.

- Foreign currency transaction loss (gain): We have excluded foreign currency transaction gains and losses from our non-GAAP profitability measures. Foreign currency transaction gains and losses fluctuate in amount and frequency and are significantly affected by foreign exchange market rates. Foreign currency transaction gains and losses are likely to recur in future periods. We believe excluding these amounts provides a useful comparison of our operational performance in different periods.

- Other: We have excluded gains and losses from our venture investments and repurchases of Convertible Senior Notes. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

- Diluted weighted-average number of common shares outstanding:

- Stock-based compensation: In periods of non-GAAP income, we’ve included the dilutive impact of stock-based compensation in our non-GAAP weighted-average shares. In periods of GAAP loss, these shares would have been excluded from our GAAP results as they would be anti-dilutive for GAAP. We believe including the dilutive effect of stock-based compensation in our non-GAAP financial measures in periods of income is helpful to investors as this provides a useful comparison of our operational performance in different periods.

|

(1) Stock-based compensation: |

|

Three Months Ended March 31, |

|||

|

2023 |

2022 |

||

|

Cost of revenue |

$ 8,912 |

$ 6,378 |

|

|

Selling and marketing |

17,661 |

10,958 |

|

|

Research and development |

9,060 |

7,346 |

|

|

General and administrative |

6,924 |

3,545 |

|

|

$ 42,557 |

$ 28,227 |

||

|

Income tax benefit |

$ (672) |

$ (5,311) |

|

|

(2) Effective income tax rates: |

|

Three Months Ended March 31, |

|||

|

2023 |

2022 |

||

|

GAAP |

(34) % |

95 % |

|

|

non-GAAP |

22 % |

22 % |

|

Our GAAP effective income tax rate is subject to significant fluctuations due to several factors, including excess tax benefits generated by our stock-based compensation plans, gains and losses on our capped call transactions, tax credits for stock-based compensation awards to research and development employees, and unfavorable foreign stock-based compensation adjustments. We determine our non-GAAP income tax rate using applicable rates in taxing jurisdictions and assessing certain factors, including our historical and forecasted earnings by jurisdiction, discrete items, and our ability to realize tax assets. We believe it is beneficial for our management to review our non-GAAP results consistent with our annual plan’s effective income tax rate as established at the beginning of each year, given tax rate volatility.

|

PEGASYSTEMS INC. RECONCILIATION OF FREE CASH FLOW (in thousands, except percentages) |

|||||

|

Three Months Ended March 31, |

|||||

|

2023 |

2022 |

Change |

|||

|

Cash provided by operating activities |

$ 68,107 |

$ 15,116 |

351 % |

||

|

Investment in property and equipment |

(11,487) |

(6,657) |

|||

|

Legal fees |

1,515 |

6,887 |

|||

|

Restructuring |

14,458 |

— |

|||

|

Interest on convertible senior notes |

$ 2,250 |

$ 2,250 |

|||

|

Free cash flow |

$ 74,843 |

$ 17,596 |

325 % |

||

|

Total revenue |

$ 325,472 |

$ 376,307 |

|||

|

Free cash flow margin |

23 % |

5 % |

|||

Our non-GAAP free cash flow measures reflect the following adjustments:

- Investment in property and equipment: Investment in property and equipment fluctuates in amount and frequency and is significantly affected by the timing and size of investments in our facilities. We believe excluding these amounts provides a useful comparison of our operational performance in different periods.

- Legal fees: Includes legal and related fees arising from proceedings outside of the ordinary course of business. We believe excluding these expenses from our non-GAAP financial measures is useful to investors as the disputes giving rise to them are not representative of our core business operations and ongoing operational performance.

- Restructuring: We have excluded restructuring from our non-GAAP financial measures. Restructuring fluctuates in amount and frequency and is significantly affected by the timing and size of our restructuring activities. We believe excluding the impact from our non-GAAP financial measures is useful to investors as these amounts are not representative of our core business operations and ongoing operational performance.

- Interest on convertible senior notes: In February 2020, we issued convertible senior notes, due March 1, 2025, in a private placement. We believe excluding the interest payments provides a useful comparison of our operational performance in different periods.

|

PEGASYSTEMS INC. |

|

ANNUAL CONTRACT VALUE |

|

(in thousands, except percentages) |

|

Annual contract value (“ACV”) – ACV represents the annualized value of our active contracts as of the measurement date. The contract’s total value is divided by its duration in years to calculate ACV. ACV is a performance measure that we believe provides useful information to our management and investors. |

|

In 2023, we changed our ACV calculation methodology for maintenance and all contracts less than 12 months to align with other contract types. Previously disclosed ACV amounts have been updated to allow for comparability. |

|

March 31, 2023 |

March 31, 2022 |

Change |

||||

|

Pega Cloud |

$ 490,568 |

$ 406,022 |

$ 84,546 |

21 % |

||

|

Maintenance |

323,760 |

317,564 |

6,196 |

2 % |

||

|

Subscription services |

814,328 |

723,586 |

90,742 |

13 % |

||

|

Subscription license |

359,323 |

313,635 |

45,688 |

15 % |

||

|

$ 1,173,651 |

$ 1,037,221 |

$ 136,430 |

13 % |

|||

|

March 31, 2022 |

June 30, 2022 |

September 30, 2022 |

December 31, 2022 |

||||

|

Pega Cloud |

$ 406,022 |

408,331 |

421,577 |

458,619 |

|||

|

Maintenance |

317,564 |

307,223 |

302,763 |

318,400 |

|||

|

Subscription services |

723,586 |

715,554 |

724,340 |

777,019 |

|||

|

Subscription license |

313,635 |

310,431 |

315,241 |

348,682 |

|||

|

$ 1,037,221 |

$ 1,025,985 |

$ 1,039,581 |

$ 1,125,701 |

|

PEGASYSTEMS INC. BACKLOG (in thousands, except percentages) |

||||||||||||

|

Remaining performance obligations (“Backlog”) – Expected future revenue from existing non-cancellable contracts: As of March 31, 2023: |

||||||||||||

|

Subscription services |

Subscription license |

Perpetual license |

Consulting |

Total |

||||||||

|

Maintenance |

Pega Cloud |

|||||||||||

|

1 year or less |

$ 235,315 |

$ 389,632 |

$ 35,346 |

$ 5,262 |

$ 41,203 |

$ 706,758 |

54 % |

|||||

|

1-2 years |

66,272 |

239,228 |

3,215 |

2,252 |

6,653 |

317,620 |

24 % |

|||||

|

2-3 years |

29,295 |

131,085 |

6,777 |

— |

2,292 |

169,449 |

13 % |

|||||

|

Greater than 3 years |

7,479 |

106,778 |

— |

— |

— |

114,257 |

9 % |

|||||

|

$ 338,361 |

$ 866,723 |

$ 45,338 |

$ 7,514 |

$ 50,148 |

$ 1,308,084 |

100 % |

||||||

|

% of Total |

26 % |

66 % |

3 % |

1 % |

4 % |

100 % |

||||||

|

Change since March 31, 2022 |

||||||||||||

|

$ (10,721) |

$ 177,239 |

$ (22,381) |

$ (6,524) |

$ (5,866) |

$ 131,747 |

|||||||

|

(3) % |

26 % |

(33) % |

(46) % |

(10) % |

11 % |

|||||||

|

As of March 31, 2022: |

|

Subscription services |

Subscription license |

Perpetual license |

Consulting |

Total |

||||||||

|

Maintenance |

Pega Cloud |

|||||||||||

|

1 year or less |

$ 228,984 |

$ 329,857 |

$ 47,428 |

$ 7,281 |

$ 40,661 |

$ 654,211 |

55 % |

|||||

|

1-2 years |

63,870 |

208,875 |

16,111 |

4,505 |

10,955 |

304,316 |

26 % |

|||||

|

2-3 years |

33,617 |

106,156 |

2,422 |

2,252 |

3,876 |

148,323 |

13 % |

|||||

|

Greater than 3 years |

22,611 |

44,596 |

1,758 |

— |

522 |

69,487 |

6 % |

|||||

|

$ 349,082 |

$ 689,484 |

$ 67,719 |

$ 14,038 |

$ 56,014 |

$ 1,176,337 |

100 % |

||||||

|

% of Total |

29 % |

59 % |

6 % |

1 % |

5 % |

100 % |

||||||

|

PEGASYSTEMS INC. RECONCILIATION OF GAAP BACKLOG AND CONSTANT CURRENCY BACKLOG (in millions, except percentages) |

|||

|

Q1 2023 |

1 Year Growth Rate |

||

|

Backlog – GAAP |

$ 1,308 |

11 % |

|

|

Impact of changes in foreign exchange rates |

28 |

3 % |

|

|

Backlog – Constant Currency |

$ 1,336 |

14 % |

|

|

Note: Constant currency Backlog is calculated by applying the Q1 2022 foreign exchange rates to all periods shown. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/pegas-focus-on-client-success-drives-strong-results-in-q1-2023-301808724.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/pegas-focus-on-client-success-drives-strong-results-in-q1-2023-301808724.html

SOURCE Pegasystems Inc.