Whenever approaching the market, investors must decide which side of the spectrum to favor: profit potential or predictability. Amid difficult circumstances, many will opt for the latter category, which could benefit utility player Portland General Electric (NYSE:POR). Thanks to its permanently relevant business along with favorable migration trends, POR stock offers a hidden-gem opportunity. As a result, I am bullish on the utility specialist.

POR Stock Makes Sense amid Rising Challenges

As an integrated electric utility company serving the state of Oregon, Portland General might not exactly be everyone’s go-to investment. Nevertheless, as certain challenges rise in the broader economy, POR stock arguably looks increasingly attractive.

First and foremost, Portland General – like other utility firms – benefits from a natural monopoly. While nothing technically prevents would-be rival enterprises from competing directly against Portland, the high barriers to entry – including regulatory hurdles – make such an idea a non-starter. And this entrenchment of the underlying business makes POR stock a must-watch.

In March, Reuters reported that tech stocks incurred an outflow of $4.4 billion over a one-week period. That was the largest outflow ever recorded, raising eyebrows among investors. True, innovative firms – backed by major advancements in artificial intelligence and other compelling technologies – have seen their valuations soar. However, nothing goes up indefinitely.

With the smart money choosing to take some profits off the table, retail investors have a difficult choice to make. Should they follow suit, or should they ride out the wave and hope for the best? While the latter approach is tempting, it also runs into some significant turbulence.

Perhaps most notably, U.S. nonfarm payrolls produced yet another solid result, reporting 303,000 in March. This stat compares very favorably to February’s gain of 270,000 jobs. Although an economy typically looks for job growth, it also means that more dollars are chasing after fewer goods. No matter how you cut it, that’s inflationary. And inflation is exactly what the Federal Reserve wants to address.

Such a framework leaves the idea of future interest rate cuts in doubt. If rates decline, money velocity could increase, exacerbating rising prices. However, if rates move higher, the economy could slow down. That leaves many investments in a pickle — except for POR stock and its ilk.

Good economy or not, you still have to pay your utility bills.

Migration Trends Could Potentially Benefit Portland General

Beyond the natural monopoly argument underlying POR stock, prospective investors also have another advantage, one that’s specific to Portland General: a favorable migration trend.

When discussing the top 10 places millennials have been moving to, the usual suspects dominate the list — basically, cities in Texas and California. However, Portland, which is one of the cities Portland General covers with its utility services, ranks within the top 20. Further, as costs of living increase in major metropolitan areas, quieter locales in states like Oregon may witness an even greater increase in net population.

Fundamentally, this dynamic should be exceptionally compelling for POR stock. The underlying company is positioned where the money will be, not just where the money currently is. Further, it’s possible that as more young people move to areas covered by Portland General, they may start raising families, leading to even greater population growth.

Therefore, it’s hard not to be encouraged by analysts’ forward projections for POR stock. For the current fiscal year, the Street anticipates earnings per share to reach $3.07 on revenue of $3.03 billion. We’re not talking blistering growth, but last year, the company produced EPS of $2.33 on sales of $2.92 billion.

Moreover, analysts believe that in Fiscal 2025, EPS could rise to $3.24 on revenue of $3.16 billion. And these are average projections. On the high side, the most optimistic expert believes revenue could clock in at $3.29 billion in Fiscal 2024 and reach $3.44 billion in the following year.

Again, given the fundamental backdrop of young people moving to Oregon, these projections are quite credible.

POR Stock’s Valuation Is Enticing

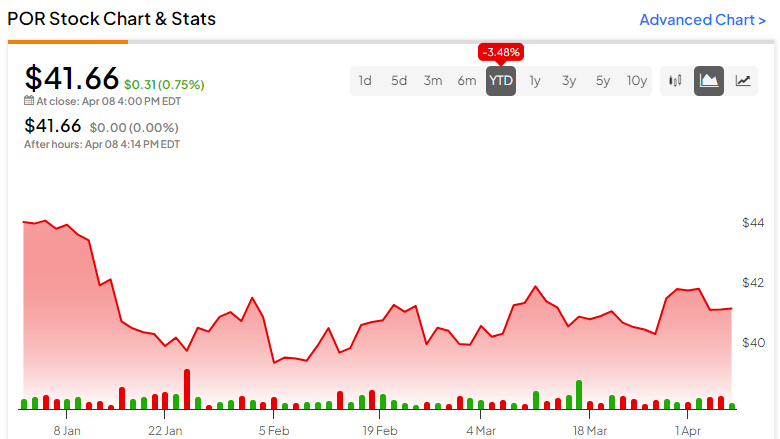

If the rotation away from risk and the youth migration trend weren’t enough catalysts, POR stock appears notably undervalued. Right now, shares trade hands at 13.4x forward earnings. It’s not quite an apples-to-apples comparison, but the average price-earnings ratio (trailing-year basis) for the regulated electric utility space stands at 17.56x.

It’s also important to consider the fundamental context. POR stock isn’t attractive just because of a mere arithmetic exercise. Rather, analysts believe that the underlying company can deliver growth in both earnings and revenue. Fundamentally, experts who study migration trends have noted that the communities Portland General covers have also witnessed significant growth.

So, if anything, POR stock should be trading at a higher valuation.

Is Portland General Electric Stock a Buy, According to Analysts?

Turning to Wall Street, POR stock has a Moderate Buy consensus rating based on four Buys, three Holds, and zero Sell ratings. The average POR stock price target is $45.43, implying 9.9% upside potential.

The Takeaway: POR Stock Is an Overlooked Utility Play

Utilities such as Portland General Electric benefit from a natural monopoly, which facilitates business entrenchment. This framework is particularly relevant right now as the smart money (for good reason) appears to be mitigating their risk-on exposure. Further, POR stock has the added benefit of being tied to a geographic location that’s experiencing positive net migration. Subsequently, its discounted valuation is credible.