Porch Group (PRCH) is an American service and software provider to the home services industry. The company provides homebuyers with a moving concierge service, helping them with critical issues, including moving, home repair, security, and insurance. (See Insiders’ Hot Stocks on TipRanks)

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factors.

Q2 Financial Results and 2021 Guidance

Porch reported revenue of $51.34 million for Q2 2021, compared to $17.12 million in the same quarter last year. The company reported a loss per share of $0.17 compared to a loss of $0.18 in the same quarter last year. Porch ended Q2 with $152.4 million in cash. (See Porch Group stock charts on TipRanks).

For full-year 2021, Porch raised its revenue outlook to $184 million from $178 million. The new estimate suggests a 155% increase in revenue over the 2020 figure.

Corporate Updates

Porch has completed the acquisition of property insurance provider Homeowners of America and is now expanding the business. Homeowners of America introduced its service in Tennessee in October 2021 as part of a nationwide expansion drive. That followed its entry into the Utah and Nevada markets in September 2021.

Porch has acquired Rynoh, a provider of software solutions to title companies, for $31.5 million. An additional payment of $3.5 million is due in 2023. Rynoh is expected to generate $8 million in revenue in 2021, with $4 million of that amount accruing to Porch’s 2021 revenue.

In September 2021, Porch raised $425 million through a convertible note offering. It plans to use the money to pay off some old debts and accelerate its acquisition strategy.

Risk Factors

The new TipRanks Risk Factors tool reveals 65 risk factors for Porch. Since Q4 2020, the company has updated its risk profile with 10 new risk factors.

Porch tells investors that its insurance businesses may be forced to sell investments at unfavorable prices to raise money to fund claims. It warns that a sale of invested assets to meet liquidity requirements could result in significant losses.

The company cautions investors that its reputation could be harmed if its insurance businesses fail to pay claims in a timely and accurate manner. Such failure could also lead to regulatory action or litigation.

Porch tells investors that economic disruptions and government interventions may lead to unfavorable conditions in the capital markets. As a result, the company may be unable to obtain financing, which could, in turn, prevent it from taking advantage of business opportunities that arise.

The majority of Porch’s risk factors fall under the Finance and Corporate category, with 35% of the total risks. That is below the sector average of 50%. Porch’s stock price has gained about 10% year-to-date.

Analysts’ Take

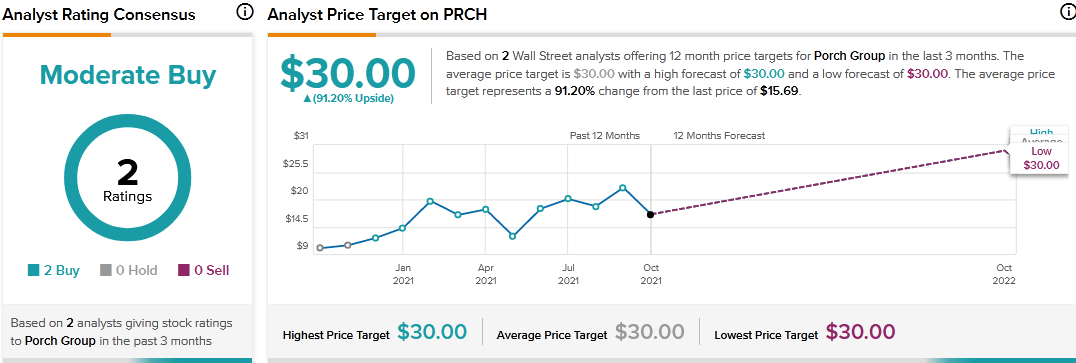

In September, Benchmark Co. analyst Daniel Kurnos reiterated a Buy rating on Porch stock and raised the price target to $30 from $26. Kurnos’ new price target suggests 91.20% upside potential. After hosting the Porch management team, the analyst thinks the company will continue to make accretive acquisitions. Further, Kurnos noted that recent deals should drive significant increases in Porch’s revenue per customer.

Consensus among analysts is a Moderate Buy based on 2 unanimous Buy ratings, both with a price target of $30 per share.

Related News:

Rocket Lab Acquires Advanced Solutions for $40M; Street Says Buy

What Do AST SpaceMobile’s Newly Added Risk Factors Tell Investors?

Analyzing Custom Truck One Source’s Newly Added Risk Factors After Nesco Merger