For anyone with a speculative itch for high-risk, high-reward ideas, Plug Power (NASDAQ:PLUG) stock offers an attractive canvas. First, the company benefits from tremendous popularity from retail investors. Second, its hydrogen fuel cell business has an outside chance of proving viable. While I wouldn’t bet the house on PLUG stock, I am bullish as a short-term trading opportunity, as it has short-squeeze potential.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

PLUG Stock Receives Much Love from Speculators

Technically speaking, one of the upside catalysts for PLUG stock centers on its extreme popularity with everyday investors. It’s not just about how many times Plug Power gets mentioned in financial publications. Rather, it’s about the hard statistics. For example, its average trading volume is nearly 45 million shares, which is sizable for a company flirting with small-cap status.

Adding to the speculative fervor for PLUG stock is the significant bearish interest in the underlying enterprise. Normally, such a dynamic would be discouraging for the average investor. However, it’s also possible for an investment to be too bearish, which may lead to a reactionary bullish move.

Specifically, PLUG stock features a short interest of 27.63% of its float. Moreover, the short interest ratio stands at 7.56 days to cover. With almost 30% of the shares publicly available for trading held short, along with the bears needing nearly eight business days to cover their position, a panic could potentially skyrocket shares higher.

To initiate a short position, a trader must first borrow securities from a broker. Upon this action, the trader immediately sells the securities in question. Should the shares fall in value, the bear can rebuy the equities at a lower price and return the borrowed amount back to the borrower. However, the speculator gets to keep the difference as the profit.

Of course, this move only works if the securities decline. If they rise in value, the bear is in real trouble since an obligation to return the borrowed equities doesn’t magically go away. In other words, short traders caught with their pants down would have to buy back the target securities at a higher price. Further, the act of buying shares naturally lifts them, which creates a positive feedback loop – the so-called short squeeze.

That’s one reason to consider the bullish angle for PLUG stock.

“Call” Up a Compelling Narrative

The other reason to add Plug Power to your watch list is fundamentally oriented; basically, the company may benefit from a compelling narrative.

First and foremost, government agencies and commercial enterprises are increasingly gravitating toward clean energy solutions for their equipment. That’s where Plug Power provides a critical service. Perhaps most notably, the company has inked agreements with Walmart (NYSE:WMT) to provide hydrogen-based solutions for the retailer’s material-handling lift trucks.

Broadly speaking, the global fuel cell market commands massive potential. In 2022, this sector reached a valuation of $5.9 billion. However, by 2029, the ecosystem could fly up to $36.41 billion, according to Fortune Business Insights, representing a compound annual growth rate of 29.7%. Therefore, it’s not inconceivable that PLUG stock could rise simply based on the fundamentals rather than just the technicals.

Either way, those who want to accelerate their possible upside rewards in PLUG stock may want to consider call options. Specifically, the May 17 ’24 3.50 Call is particularly appealing for its high volume and open interest. As a result, this option features a relatively low bid-ask spread compared to an in-the-money (ITM) $3 call of the same expiration date.

Another reason why the $3.50 call is attractive is because the bulls will likely drive shares to the $4 level. Psychologically, the market prefers round numbers, so you can use this phenomenon to your advantage. Should PLUG stock reach $4 or close to it reasonably quickly, the $3.50 call would enjoy a mixture of time and intrinsic value.

Risk Factors to Watch

Before diving into PLUG stock, prospective investors must consider the risks facing the enterprise. Key among them is the extreme volatility. In the past 52 weeks, PLUG stock has lost 69% of its value. Obviously, that’s not a good look.

Second, three analysts have rated shares a Sell. Generally, analysts want to keep diplomatic relations with the management teams of the companies they cover. So, a clear bearish signal represents a true indictment against the enterprise.

Third, based on its price-to-book ratio of 0.8x, the market is valuing Plug Power at less than its equity value (net worth). Again, that’s not a good look. Still, on a positive note, such extreme undervaluation might be viewed as a discounted opportunity. After all, the hydrogen fuel cell market is projected to be an expanding one.

Is PLUG Stock a Buy, According to Analysts?

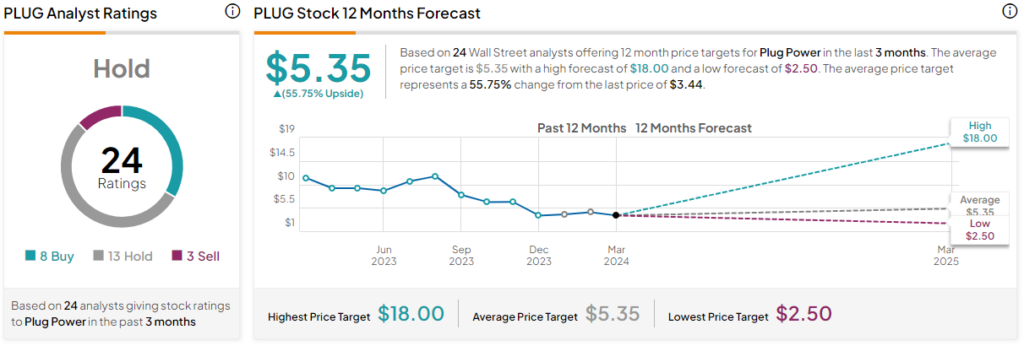

Turning to Wall Street, PLUG stock has a Hold consensus rating based on eight Buys, 13 Holds, and three Sell ratings. The average PLUG stock price target is $5.35, implying 55.75% upside potential.

The Takeaway: A Bold Bet for the Bullish Speculator

Let’s not get this narrative confused: PLUG stock is an extremely risky idea. Subsequently, the bears have attacked it with gusto. Nevertheless, a short squeeze might materialize since the stock benefits from strong retail support and a burgeoning addressable market. Given this dynamic, it wouldn’t be completely unreasonable to consider certain near-expiry call options.