It’s not always a good day when a stock offers new convertible notes. But today, it was fantastic news for green hydrogen stock Plug Power (NASDAQ:PLUG), who offered up a new pile of convertible senior notes amid the cheers of shareholders. In turn, shareholders sent Plug Power shares blasting up over 8.5% in Wednesday afternoon’s trading.

More specifically, Plug Power brought out $140.4 million worth of convertible senior notes at a 7% rate, which will come due in 2026. The new notes were almost a straight exchange for a previous set, a $138.8 million block of notes due 2025, but at a rate of 3.75%. That included accrued and unpaid interest so far, and the relevant 2025 notes were canceled after the new notes were issued.

However, not all of the old notes were canceled, as about $58.5 million of the 2025 notes were left untouched by this new development. While the interest rate has increased significantly—it’s actually doubled—Plug Power now has an extra year to work with.

Extra Time May Be Helpful for Plug Power

That extra time may be helpful for Plug Power, especially given what’s going on. A class action lawsuit from Plug Power investors is already in the offing, led by Holzer Law. The lawsuit features such phrases as “…continued to experience delays related to its green hydrogen production facility build-out plans” and “…made materially false and misleading statements…regarding the Company’s business…”

With analysts calling attention to other green hydrogen stocks in the field and Plug Power itself reeling from a fourth-quarter earnings report packed with bad news, it’s not the kind of thing that bodes well going forward.

Is Plug Power a Buy or Sell?

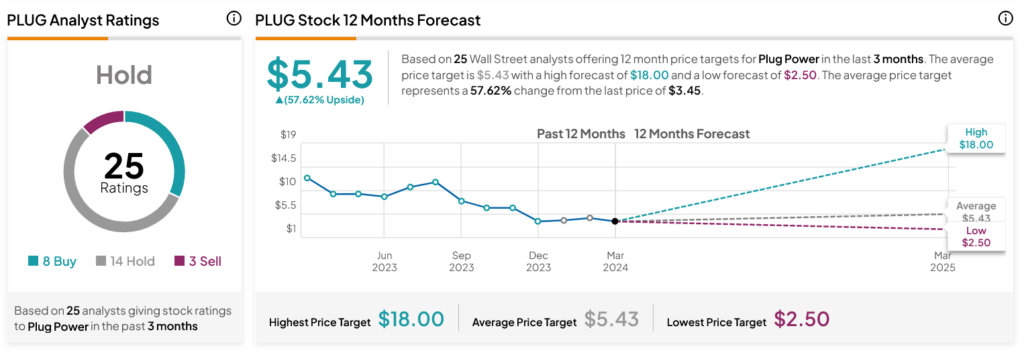

Turning to Wall Street, analysts have a Hold consensus rating on PLUG stock based on eight Buys, 14 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 66.44% loss in its share price over the past year, the average PLUG price target of $5.43 per share implies 57.62% upside potential.