Plug Power (NASDAQ:PLUG) shares plummeted by nearly 9% in the premarket session today after the hydrogen fuel cell solutions provider’s first-quarter results lagged expectations.

Its revenue plunged by nearly 42.8% year-over-year to $120.3 million. The figure missed expectations by a wide margin of $36.4 million. In sync, its net loss per share of $0.46 came in wider than estimates by $0.13. This represents a significant increase compared to the previous year, when PLUG reported a net loss per share of $0.35.

PLUG’s Disappointing Performance

The drop in the company’s top line was primarily driven by lower equipment and associated infrastructure sales, which declined to $68.3 million from $182.1 million a year ago. Its smaller segments, however, fared better. Revenue from Power Purchase Agreements increased to $18.3 million from $7.9 million, and revenue from Services and Fuel Deliveries ticked up to roughly $31.3 million from $19.2 million a year ago.

This dismal top-line performance was accompanied by margin pressures for PLUG. In Q1, the company experienced challenges in its equipment margin due to its focus on lowering inventory and limiting output. The focus on lowering inventory is part of PLUG’s strategy to enhance its cash position.

While its first-quarter performance was disappointing, PLUG has undertaken multiple actions in recent times to boost its fortunes. So far, its efforts have included restructuring, lowering headcount, asset impairment, and price increases. Meanwhile, PLUG is also facing a class action lawsuit over deceiving investors about delays in the build-out plans of its green hydrogen production facility.

What Is the Target Price for PLUG?

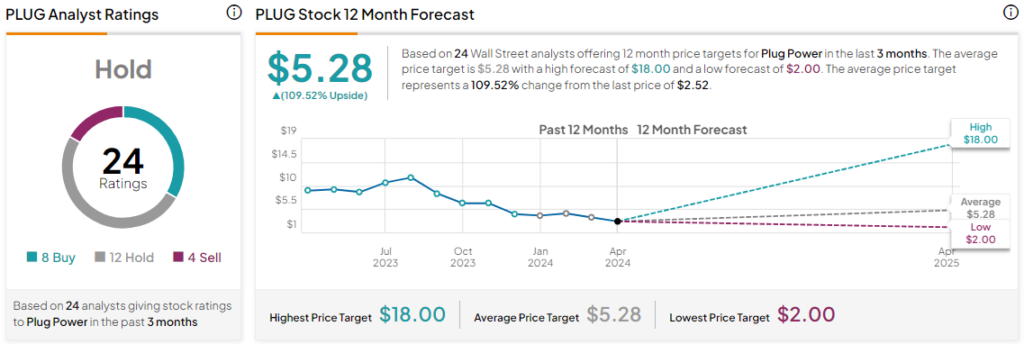

Notably, PLUG has reported continued losses in recent years, and its stock price has followed suit, with a decline of nearly 87% over the last three years. Overall, the Street has a Hold consensus rating on the stock, alongside an average PLUG price target of $5.28. However, analysts’ views on the company could see changes following today’s earnings report.

Read full Disclosure