There’s trouble ahead for Editas Medicine (NASDAQ:EDIT), a biotech stock that released a new plan to raise cash. The problem, and what led to Editas closing down 3.31% in Wednesday’s trading and continuing its slide after hours, is just what the plan consisted of. The plan featured Editas set to offer up $125 million worth of stock in a public offering that’s already landed an underwriter. The underwriter, in turn, will receive a 30-day option to buy $18.8 million in stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Editas plans to sell all the shares as part of the offering, though it’s as yet unclear just how many shares will be involved or what those shares’ prices will be. Editas might have thought it a particularly good time to make such a move, given its recent run-up. After revealing new data on its EDIT-301 treatment for sickle cell disease, it might well have thought that it could piggyback on that success. With a roughly 70% chance of approval—based on Raymond James analyst Steven Seedhouse‘s projections—they might have been right on a lesser amount. But offering up $125 million in new stock when your current market cap is around $768 million is never met with much enthusiasm from shareholders.

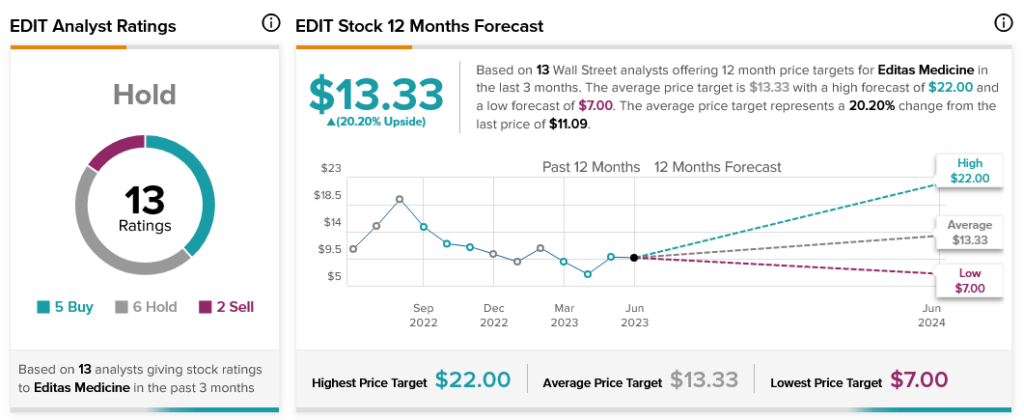

Analysts are split on EDIT stock. With five Buys, six Holds, and two Sells, analyst consensus calls it a Hold. Further, it comes with 20.20% upside potential thanks to its average price target of $13.33.