Fitness chain Planet Fitness (NYSE:PLNT) is planning to update its franchisee economic model amid the currently challenging macroeconomic environment.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

These changes are expected to be designed to lower certain capital investments to improve the attractiveness of returns to franchisees. The company plans to make changes to the mix of cardio and strength equipment, while extending the time required to replace the equipment and complete remodels of the gyms.

Further details on the changes to the franchisee model are expected on November 7, when PLNT is scheduled to announce its third-quarter numbers. Analysts expect PLNT to post an EPS of $0.55 on revenue of $267.54 million for the quarter. In the comparable year-ago period, PLNT posted an EPS of $0.42, comfortably outpacing estimates by $0.38.

Shares of the popular fitness chain have soared by nearly 17% over the past month after investors digested a sudden shakeup at its top rung. The company’s Board replaced long-time CEO Chris Rondeau with Craig R. Benson. Benson is a Planet Fitness franchise owner and has been on the company’s Board for six years. Acting as PLNT’s CEO for a decade, Rondeau had overseen a 5.5x jump in the company’s membership and a 4x jump in its store footprint.

Is Planet Fitness a Good Stock to Buy?

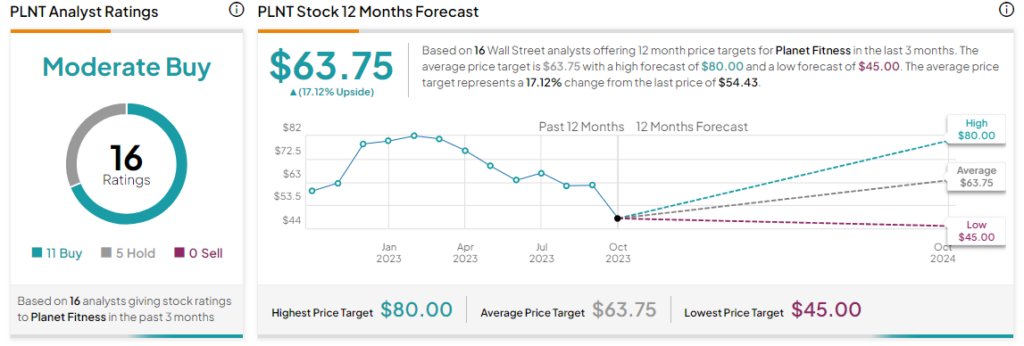

Overall, the Street has a Moderate Buy consensus rating on Planet Fitness. The average PLNT price target of $63.75 implies a nearly 17% potential upside.

Read full Disclosure

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue