Philips (PHG), the Dutch health technology company, has reported Q3 earnings. The company beat EPS, with its non-GAAP EPS of €0.25 above estimates by €0.16. However, its €4.3B revenue missed by €60M. The company showed a 5% comparable sales decline, and a comparable order intake decrease of 6%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company simultaneously announced that it will engage in immediate restructuring activities, with the expectation of approximately EUR 300 million charges. As of October 15, the company has installed a new CEO and President, Roy Jakobs, and he expressed his dedication toward improving the business drastically.

Is PHG a Buy?

PHG stock has gotten two Hold ratings from analysts in the past month. Furthermore, Philips stock has dropped by 71.7% in the past year. Both of those statistics are not heartening for investors.

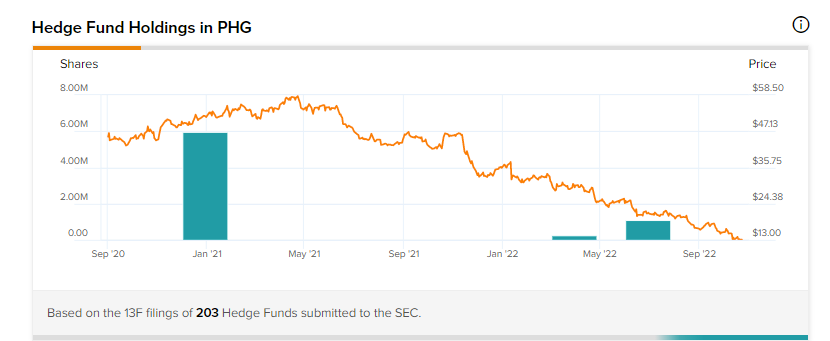

On the other hand, some hedge funds seem hopeful about Philips stock. Three hedge funds bought the stock in the past quarter, with Fisher Asset Management and Brandes Investment Partners purchasing the stock for the first time. In total, hedge funds increased holdings by 825.9K shares last quarter.