The Procter & Gamble Co.’s (NYSE:PG) Fiscal third-quarter sales disappointed investors as they inched higher by just 1% year-over-year to $20.2 billion and fell short of consensus estimates of $20.5 billion. Interestingly, prices of P&G products across the board increased by 3% year-over-year in Q3. However, the rise in prices did not seem to impact its volumes, as they had a neutral impact on its sales in the third quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, the consumer goods company’s core earnings increased by 11% year-over-year to $1.52 per share, beating consensus estimates of $1.41 per share.

The company’s Board of Directors has approved a 7% year-over-year increase in its quarterly dividend to $1.0065 per share on the common stock, as well as on the Series A and Series B ESOP Convertible Class A Preferred Stock. The dividend will be payable on or after May 15 to shareholders of record and ESOP Convertible Class A Preferred Stock shareholders as of the close of business on April 19.

Looking ahead to FY24, PG anticipates that its sales will grow to between 2% and 4% year-over-year, with organic sales expected to increase by 4% to 5%. Furthermore, the company has projected its diluted net earnings for FY24 to grow between 1% and 2% year-over-year.

Is PG a Good Stock to Buy Now?

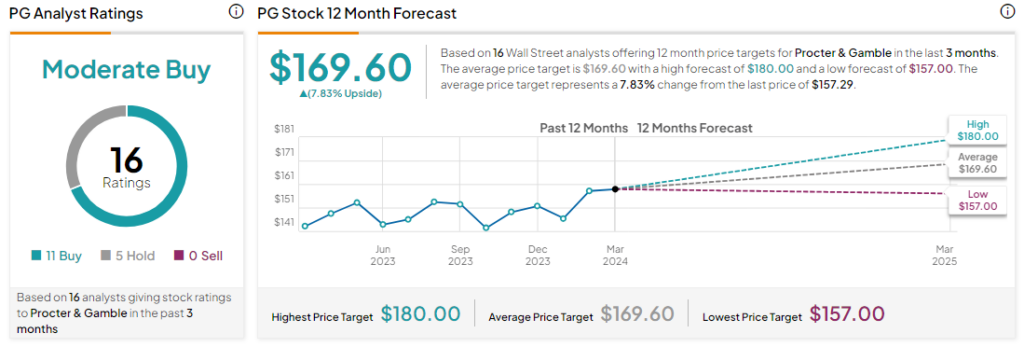

Analysts remain cautiously optimistic about PG stock, with a Moderate Buy consensus rating based on 11 Buys and five Holds. Year-to-date, PG stock has gained by more than 8%, and the average PG price target of $169.60 implies an upside potential of 7.8% from current levels. These analyst ratings will likely change today after Procter & Gamble’s Fiscal third-quarter results.