According to a report published by Reuters, Pfizer, Inc. (NYSE: PFE) plans to invest €520 million ($594 million) in France during the next five years as part of the company’s strategy to increase the production of its antiviral COVID-19 pill, Paxlovid.

The plan includes the addition of a production facility for Paxlovid, which has demonstrated almost 90% efficacy in preventing deaths and hospitalizations among COVID-19 patients.

Initially, the pharmaceutical giant will produce an active pharmaceutical ingredient (API) for Paxlovid at the plant, which will be operated by a local biopharmaceutical firm, Novasep.

Pfizer expects to incorporate Novasep’s Mourenx plant, in southwest France, into its global supply chain for Paxlovid in the third quarter. It also aims to include other Novasep facilities next year.

Pfizer said, “Novasep will produce API for use in our manufacturing network, expected to contribute to the overall (global) effort to produce 120 million courses of treatment in 2022.”

The multinational company also plans to use a portion of the investment amount for research partnerships with biotech firms in France.

Meanwhile, Paxlovid received Emergency Use Authorization from the U.S. FDA in December. Further, Pfizer is assessing the drug for possible authorization in the EU.

About Pfizer

Based out of New York, Pfizer develops, manufactures and sells medicines and vaccines for immunology, oncology, cardiology, endocrinology, and neurology.

Wall Street’s Take

Last week, BMO Capital (LON: BCI) analyst Evan Seigerman maintained a Buy rating on Pfizer and raised the price target to $76 from $60 (38.3% upside potential).

Seigerman, in a research note to investors, said, “Pfizer could be the first pharma company to break $100 billion revenues boosted by Paxlovid sales this year.”

Additionally, Carter Gould from Barclays (LON: BARC) maintained a Hold rating on the stock with a $54 price target (1.7% downside potential).

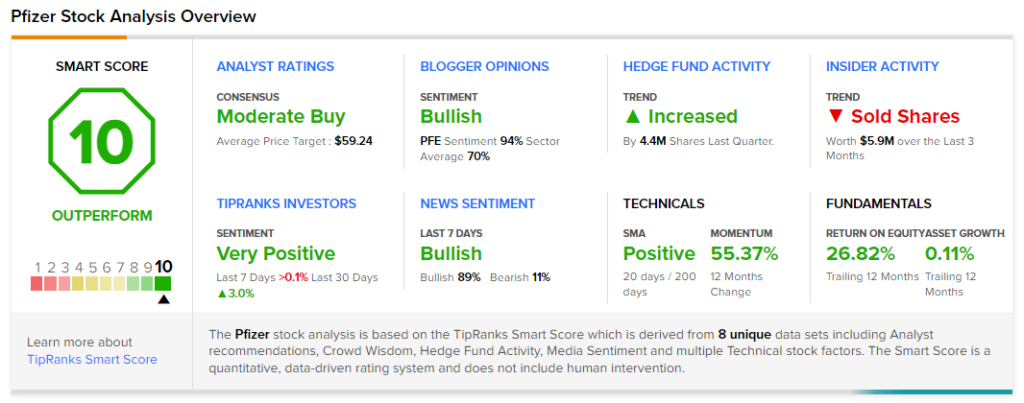

Overall, the stock has a Moderate Buy consensus rating based on 8 Buys and 10 Holds. The average Pfizer price target of $59.24 implies 7.8% upside potential. Shares have gained 55.5% over the past year.

Smart Score

Pfizer scores a “Perfect 10” from TipRanks’ Smart Score rating system. This makes it one of TipRanks’ Top Stocks and implies that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Emerge Hires Ocgrow Ventures CEO; Shares Pop

Amazon Overturns Ban on Visa Credit Cards In the UK

Woodward Inc. Updates 2 New Risk Factors