PerkinElmer raised its revenue outlook for 3Q on Monday citing strong demand for its COVID-19 testing solutions. The company projects 3Q reported and organic sales to increase by 35% and 33%, respectively, on a year-over-year basis. Analysts had estimated sales to grow 16.3% from the $707 million generated in the year-ago quarter.

Earlier, during its 2Q earnings release, PerkinElmer’s (PKI) had anticipated 3Q revenues in the range of $760-$860 million, reflecting a year-on-year growth of between 7.5% and 21.5%.

The company noted that “strong revenue growth performance was driven by continued better-than-expected demand for PerkinElmer’s full-suite of solutions aimed at helping support customers’ COVID-19 testing needs across the globe.”

PerkinElmer’s COVID-19 related solutions generated approximately $280 million of revenues during the 3Q. The company said that “Demand for the Company’s RT-PCR, RNA extraction systems and kits, and automated liquid handling instrumentation remained robust.” (See PKI stock analysis on TipRanks)

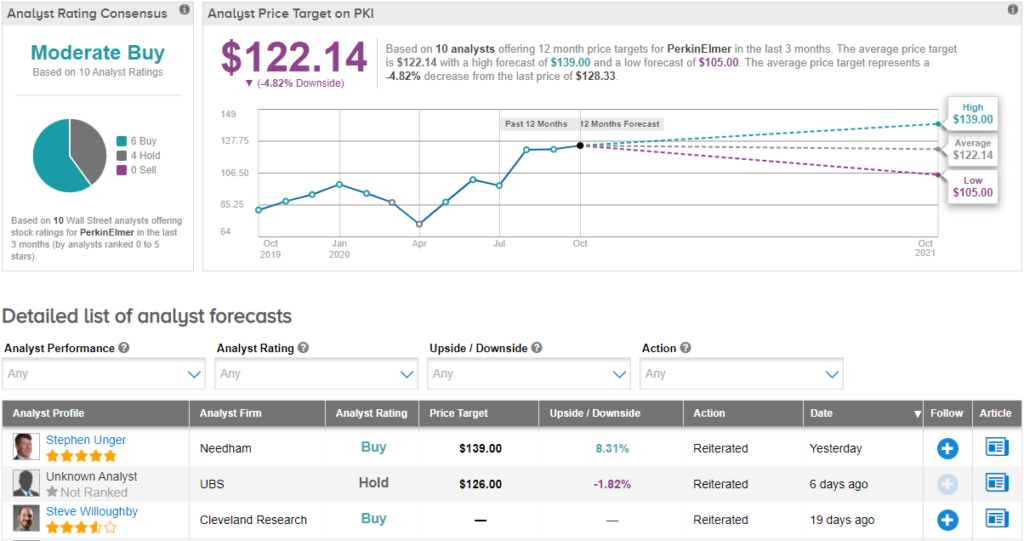

Following its revised sales outlook, Needham analyst Stephen Unger reiterated his Buy rating and the price target of $139 (8.3% upside potential). Unger said “We remain impressed with the level of global adoption of PKI’s broad portfolio of testing solutions related to COVID-19, which clearly bodes well for 2H20 into 2021.”

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 6 Buys and 4 Holds. With shares up over 32% year-to-date, the average price target of $122.14 implies downside potential of 4.8% to current levels.

Related News:

Pfizer, BioNTech Initiate Rolling Canada Submission For Covid-19 Vaccine

Eli Lilly In Gates Foundation Supply Deal For Covid-19 Antibodies

Kymera Therapeutics Pops 10% On Positive Skin Disorder Data