Beverage giant PepsiCo (NASDAQ:PEP) declined in pre-market trading after its net revenues dipped by 0.5% year-over-year in the fourth quarter to $27.85 billion. This fell short of consensus estimates of $28.4 billion. In addition, volumes dipped by 2% and 1% for its Foods and Beverages categories, respectively. However, organic revenues grew 4.5% year-over-year.

Pepsico’s core earnings also increased by 9% year-over-year to $1.78 per share, exceeding Street estimates of $1.72 per share. Moreover, Pepsico announced a 7% increase in its annualized dividend to $5.42 per share, starting in June 2024.

Looking forward to FY24, Pepsi estimates organic revenue growth of at least 4% and expects its core constant currency earnings to grow by at least 8% per share. This implies a core EPS of at least $8.15, a 7% year-over-year increase.

Is PEP a Buy, Sell, or Hold?

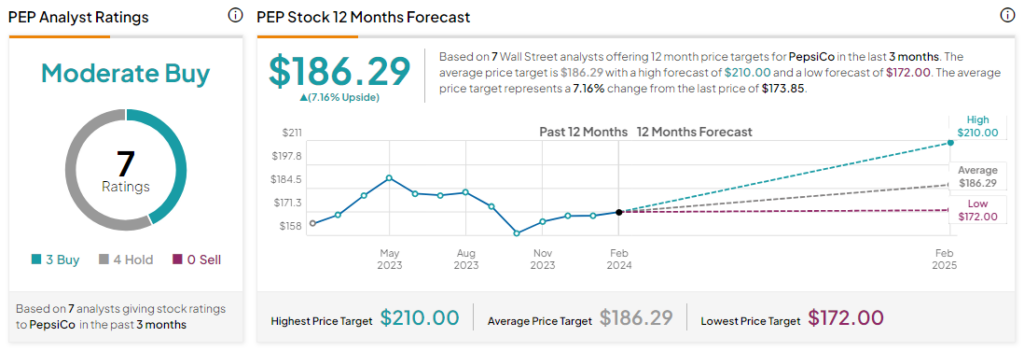

Analysts remain cautiously optimistic about PEP stock with a Moderate Buy consensus rating based on three Buys and four Holds. Over the past year, PEP stock has gained by more than 3%, and the average PEP price target of $186.29 implies an upside potential of 7.2% at current levels.