Peabody Energy (NYSE:BTU) and Coronado Global Resources (AU:CRN) have decided to call off the long-speculated $6 billion deal to combine both entities with an aim to create a global coal leader. Shares of Peabody Energy gained 13% on November 4 and are trending another 6% higher in the pre-market trading hours today.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Peabody Energy is the largest coal mining company in the U.S., while Coronado Global Resources is based in Australia and is a leading international producer of high-quality metallurgical coal, an essential element in steel production.

The reason for the closure of talks, which began in October, was not revealed. However, Coronado stated that it will continue to focus on ongoing capital investments as well as long-term development initiatives.

Peabody Energy Posts Upbeat Q3 Results

The company reported robust Q3 results on November 3. Peabody’s adjusted earnings of $2.34 per share handily beat the analysts’ estimates of $1.79 per share. Also, the figure came in much higher than the Q3FY21 loss of $0.60 per share. Furthermore, total net revenue jumped 97.3% year-over-year to $1.34 billion.

Is BTU Stock a Good Buy?

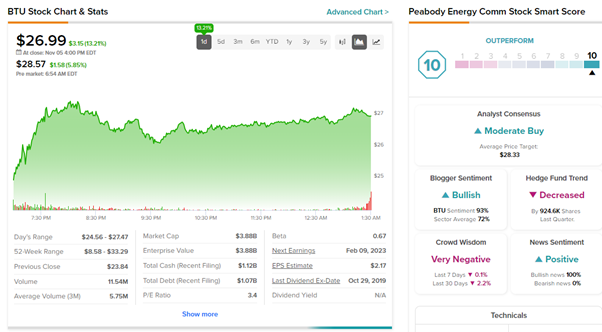

On TipRanks, analysts are cautiously optimistic about the Peabody Energy stock and have a Moderate Buy consensus rating, which is based on two Buys and one Hold. Peabody Energy’s average price forecast of $28.33 implies 4.96% upside potential.

Notably, BTU stock has a top-notch Smart Score of a “Perfect 10” on TipRanks, indicating that the stock has strong potential to outperform market expectations.

Read full Disclosure