Shares of digital payment giant PayPal (PYPL) have begun to retreat from the rally it saw earlier today. The company’s warning that consumers in the U.S. and Europe are spending less amid economic pressure appears to be sinking in.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During pre-market trading on Tuesday, PYPL stock soared over 14%, extending its gains from the previous day. This came after the fintech company reported Q3 2025 results that exceeded Wall Street’s expectations and announced an agreement with ChatGPT maker OpenAI (PC:OPAIQ) to enable PayPal payments directly in the AI startup’s artificial intelligence chatbot starting next year.

PayPal Stock Retreats from Rally

However, following a warning on consumer spending from Jamie Miller, PayPal’s chief financial officer, during his remarks to analysts after the earnings release, the company’s shares started to pare back. PYPL stock traded about 9% higher as of 1:03 p.m. EDT on Tuesday.

PayPal’s latest financial results show that its revenue rose 7% to $8.4 billion, compared with the same period last year. The fintech’s total payment volume also expanded by 8% year over year to $458.1 billion.

Meanwhile, Miller noted that PayPal’s average order value decreased in September across the U.S. and Europe, especially among retail consumers who are more selective in their purchases. The CFO added that the trend has continued into this month in both markets.

Consumer Retail Demand Softens

Miller’s comment comes as recent data indicated that U.S. core retail sales — which excludes volatile sectors such as automobiles, gasoline, and food services — cooled slightly in September compared with the prior month. While the data is debated, some analysts believe the data points to the possibility of consumer spending slowing, especially among younger and lower-income consumers.

Furthermore, the latest report from the Michigan Current Conditions Final Index, a key measure of American consumers’ confidence in the present state of the economy, showed a lower assessment of the U.S. economy’s current condition. This indicated potential softness in consumer spending.

However, PayPal expects the approaching holiday season to boost spending. The company also raised its full-year 2025 guidance, with an adjusted earnings-per-share range that trumps Wall Street’s estimates.

Is PayPal Stock a Buy, Sell, or Hold?

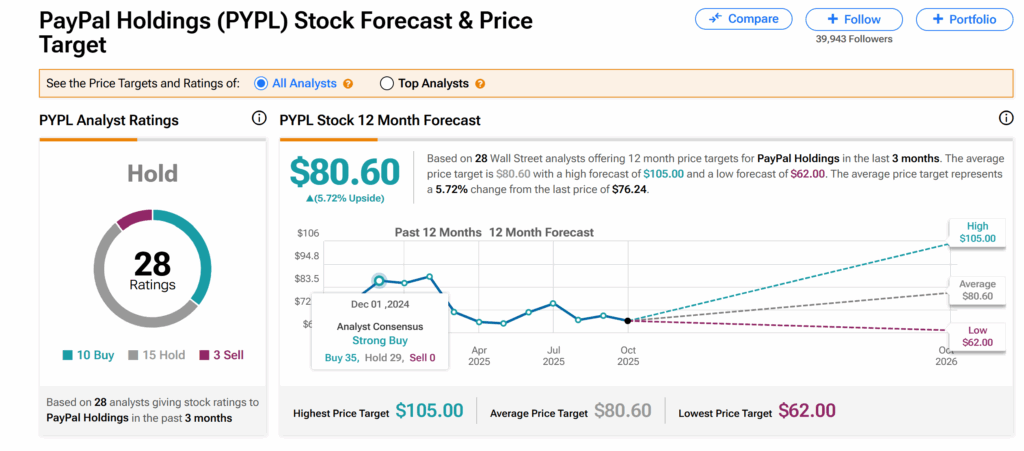

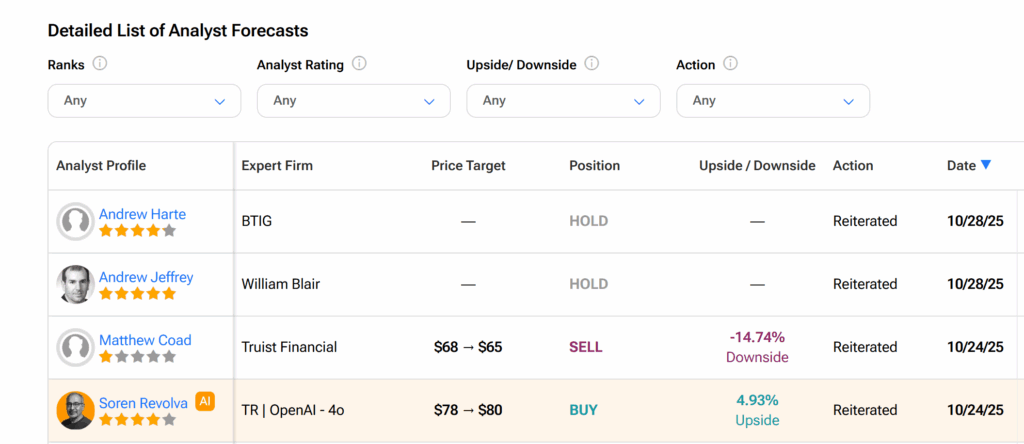

Turning to Wall Street, PayPal’s shares currently have a Hold rating, according to TipRanks data. This is based on 10 Buys, 15 Holds, and three Sells issued by 28 analysts over the past three months.

Moreover, the average PYPL price target of $80.60 suggests about 6% upside from the current level.