Payments processor PayPal (NASDAQ:PYPL) has made a lot of changes in the last few days, and investors seem reasonably happy with them. While it’s a safe bet all these changes will take a while to process fully, investors were good enough with the changes to push PayPal up fractionally in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The first major change at PayPal came from one of its own investors. Elliott Investment Management dropped its entire PayPal stake, which at the end of the first quarter was one million shares strong. That’s quite a bit of investment to suddenly hit the open market, and a significant sign of no confidence from a major investor could easily color the rest of investors’ perceptions. Given that Elliott staffers declared that PayPal “…has an unmatched and industry-leading footprint across its payments businesses and a right to win over the near and long term,” such a departure could only be considered a shock.

Changes continued from there. PayPal found a new CEO in Alex Chriss, who would be taking over for Dan Schulman starting September 27. Chriss will take arms against a sea of troubles, as growth slows for both PayPal and its Venmo arm, and competitors like Apple Pay step up their efforts to dethrone PayPal. Further, PayPal’s push into cryptocurrency came to a temporary halt. PayPal’s UK division will stop all purchases of cryptocurrency until 2024. That’s to keep in line with some new UK laws about cryptocurrency advertising.

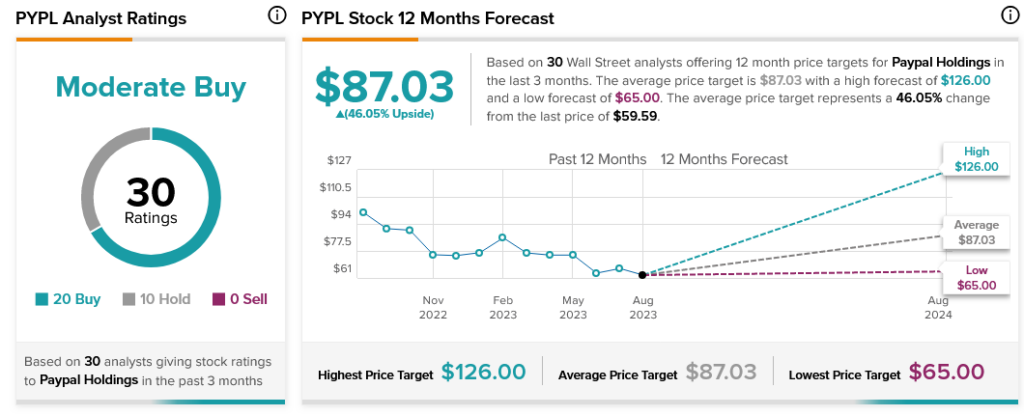

Analysts, meanwhile, have high expectations for PayPal. Analysts call PayPal stock a Moderate Buy, supported by 20 Buy ratings and 10 Hold. Meanwhile, PayPal stock also comes with an upside potential of 46.05% , thanks to its average price target of $87.03.