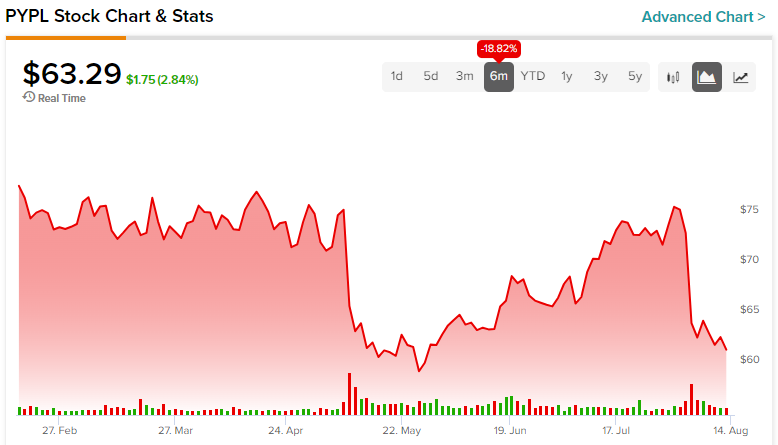

Shares of fallen fintech firm PayPal (NASDAQ:PYPL) can’t catch a break these days, now flirting with multi-year lows again on the back of a weak quarterly earnings result. More recently, PayPal has garnered attention for its ambitious plans to make a bigger splash in cryptocurrencies with the launch of its stablecoin. Though I view the move as relatively low-risk (but not completely risk-free), investors don’t seem enthralled by the news.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

There was an initial pop of around 3%, but the gains have since been wiped out. Personally, I’m with the herd on this one. Crypto and PayPal don’t seem like a combo that could meaningfully reverse the stock amid its historic slump. As such, I am neutral on the stock.

Indeed, it seems like the crypto hype faded a long time ago. These days, there are not nearly as many talking heads or television commercials touting digital tokens of wallets. In any case, PayPal still has an impressive network (435 million users strong) that it can and should put to good use as it looks to sustain some sort of turnaround, although stablecoin demand has cooled quite a bit from its peak, thanks in part to the notable blow-up of Luna and the untethering of Tether (USDT-USD).

PayPal is a Well-Established Firm That Could Do Stablecoins the Right Way

PayPal’s stablecoin could have one big thing going for it — the backing of a respected brand in the arena of financial technology. Undoubtedly, many people have trusted PayPal with their personal and business funds for decades, and though the stock’s in a slump amid rising competition, crypto and well-established brands like PayPal could mesh well. Still, it may not be enough to turn the stock around.

Also, the wild world of crypto can be quite choppy from a regulation standpoint. In that regard, PayPal may be inviting negative attention as it gets into the stablecoin waters. Recently, Congresswoman Maxine Waters noted she was “deeply concerned” about a launch of a PayPal stablecoin.

Surely, PayPal could risk getting a tad ahead of its skis as it looks to find some way to turn its ailing stock around. I believe an overly-hasty launch could cause issues and potentially erode PayPal’s trusted reputation. When it comes to crypto, firms must be ready to tackle all the regulatory hurdles.

Though Waters’ comments are a tad concerning, PayPal will likely have to play ball to gain the trust of Congress as well as the general public. In the meantime, it’s really tough to look past PayPal’s underwhelming second-quarter results.

PayPal’s Quarter Sinks Stock Further Into the Abyss

PayPal delivered an earnings-per-share (EPS) result of $1.16, meeting consensus estimates. Revenue rose 7% year-over-year to $7.3 billion, marking yet another quarter of stalling top-line growth. Undoubtedly, there’s growing concern that PayPal’s growth may be weighed down by competitors in the digital payments space, even as consumer spending recovers. I view the ugly post-earnings reaction as warranted and think that the stock is a falling knife that could prove very painful to catch.

The $120 billion stablecoin market may be ripe for disruption, but I don’t see how the firm can convince its hundreds of millions of users to swap their dollars for tokens. The company is either too late or too early to the game. Either way, I wouldn’t get my hopes up for the stablecoin launch, as I don’t think it’s enough to garner investor enthusiasm again.

Is PYPL Stock a Buy, According to Analysts?

On TipRanks, PYPL stock comes in as a Moderate Buy. Out of 31 analyst ratings, there have been 20 Buys and 11 Holds assigned in the past three months. The average PayPal stock price target is $87.03, implying upside potential of 37.6%. Analyst price targets range from a low of $65.00 per share to a high of $126.00 per share.

The Bottom Line on PYPL Stock

PayPal stock is unloved and in need of a new catalyst following a tough quarterly result. Only time will tell if PayPal’s users will have any interest in a stablecoin. Either way, macro headwinds and fiercer competition in payments are daunting enough to leave me glued to the sidelines.