Payments technology company PayPal (NASDAQ:PYPL) is focusing on enhancing profitability and boosting growth by reducing costs. As part of its restructuring initiative, PYPL plans to cut 9% of its total workforce in 2024, according to several media reports.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s noteworthy that PayPal is facing increased competition and margin headwinds, which are pressuring its stock price. In response to competitive challenges, PayPal launched the “Quantum Leap” project. This initiative aims to introduce new features to its digital wallet and online checkout and increase the adoption of its offerings.

It’s worth highlighting that the company is scheduled to announce its Q4 2023 financial result on February 7.

PYPL – Q4 Expectations

Wall Street expects PayPal to post revenue of $7.88 billion in Q4 compared to $7.4 billion in the prior-year quarter. The year-over-year improvement will likely come from increased total payment volume.

The increase in sales and cost-saving initiatives are likely to cushion its earnings. Analysts expect PayPal to post earnings of $1.36 per share in Q4, up from $1.24 in the prior-year quarter.

What is the Prediction for PayPal Stock?

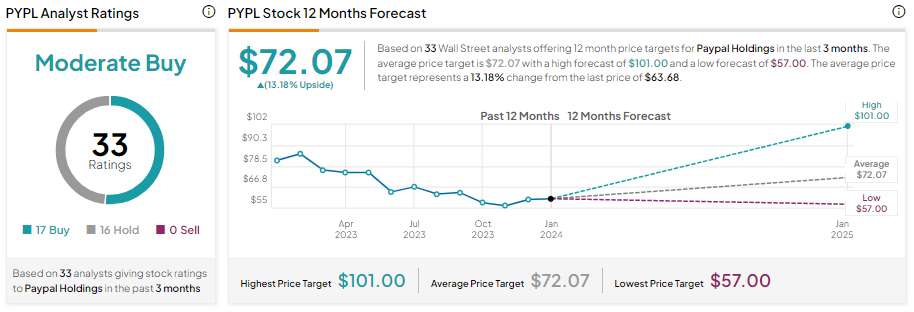

Wall Street analysts are cautiously optimistic about PayPal stock ahead of Q4 earnings. With 17 Buy and 16 Hold recommendations, PYPL stock has a Moderate Buy consensus rating.

PayPal stock has decreased approximately 22% over the past year. Analysts’ average price target of $72.07 implies 13.18% upside potential from current levels.