The Financial technology company PayPal (NASDAQ:PYPL) is working on a project named Quantum Leap, The Information reported. Per the report, PayPal’s new CEO, Alex Chriss, has ramped up efforts to safeguard its market position and address competitive pressures from tech giant Apple (NASDAQ:AAPL) and financial services company Stripe.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s dig deeper.

PayPal’s Quantum Leap

The Quantum Leap initiative involves Chriss instructing various teams within PayPal to swiftly introduce innovative features, thereby enhancing the appeal of its digital wallet and online checkout for both consumers and merchants. The company aims to implement these changes as early as March, as the report highlighted.

With a focus on accelerating growth and driving profitability, PayPal needs more and more consumers and merchants to use its products. To achieve the same, Chriss said during the Q3 conference call that the company is using resources to revamp its consumer experience.

Additionally, PayPal is concentrating on enhancing and expanding the PayPal Complete Payments service for small businesses globally. At the same time, it is taking initiatives to improve margins in Braintree and other enterprise-focused products.

What is the Prediction for PayPal Stock?

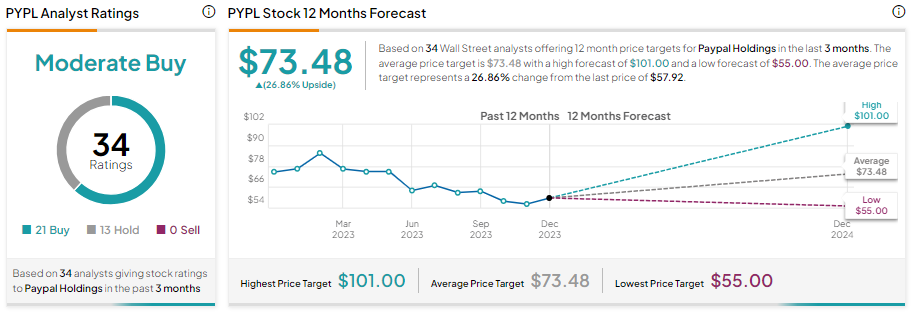

PayPal stock has underperformed the broader markets so far this year and is down about 19% year-to-date over margin concerns. This is reflected in analysts’ cautiously optimistic outlook.

PYPL stock has received 21 Buy and 13 Hold recommendations for a Moderate Buy consensus rating. Further, the average PYPL stock price target of $73.48 indicates that it has the potential to go up by 26.86% from current levels.