What can I say? Just about every rule out there has an exception, and today, payment platform PayPal (NASDAQ:PYPL) proved itself one such exception. Despite PayPal taking its second downgrade from analysts in as many days, investors rallied behind it and sent shares up nearly 3% in Friday morning’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This time, the downgrade came from BTIG via analyst Andrew Harte. Harte noted that the “…process of returning the company to consistent and profitable revenue growth…” was an event that would likely be years in the making. Harte dropped the rating from Buy to Neutral and suggested that there’s just “too much uncertainty” floating around this stock to make it a decent recommendation. Indeed, during its third-quarter earnings call, PayPal pointed out that it’s shifting its focus for 2024 and will update investors on that during the upcoming earnings call in February.

Indeed, Plenty of Uncertainty

Harte has a point here about uncertainty. That’s particularly true given that PayPal just changed horses in the middle of the stream; Dan Schulman is stepping down as CEO, while Alex Chriss will step in in his place. Schulman knew PayPal needed new leadership, and Chriss—with an extensive background in funding for small businesses and the self-employed—would fit the bill well. Given how many small businesses and self-employed individuals turn to PayPal to get their invoices paid and to make purchases, it’s no surprise PayPal would call on someone like Chriss. Chriss spent no shortage of time with Intuit (NASDAQ:INTU), improving its stance with small businesses and the self-employed.

What is PayPal’s Price Target?

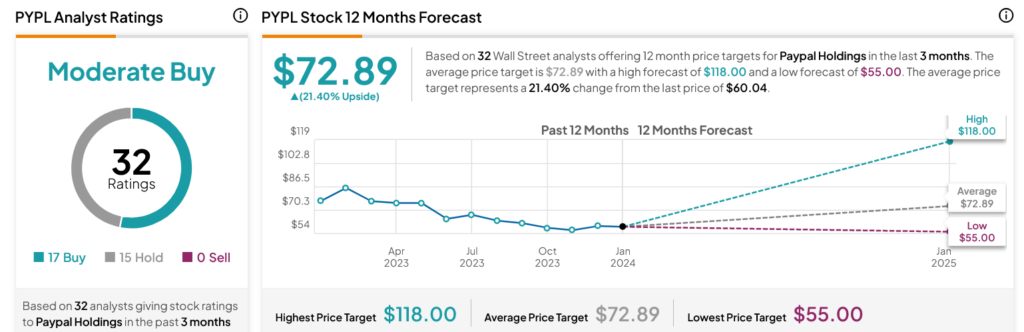

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PYPL stock based on 17 Buys and 15 Holds assigned in the past three months, as indicated by the graphic below. After a 21.33% loss in its share price over the past year, the average PYPL price target of $72.89 per share implies 21.4% upside potential.