Despite PayPal’s (NASDAQ:PYPL) muted performance over the past year, the stock has generally been on the rise since the digital payments’ leader’s Q3 print. However, when considering the company’s prospects, Oppenheimer analyst Dominick Gabriele admits that the uptick has now given him the opportunity to step aside.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

“The recent stock rally brings PYPL’s valuation more in line with PYPL’s improving Ecomm volumes, we expect,” Gabriele explained, “and thus we see better opportunity in peers. We are incrementally positive on payment stocks but move to the sidelines on PYPL.”

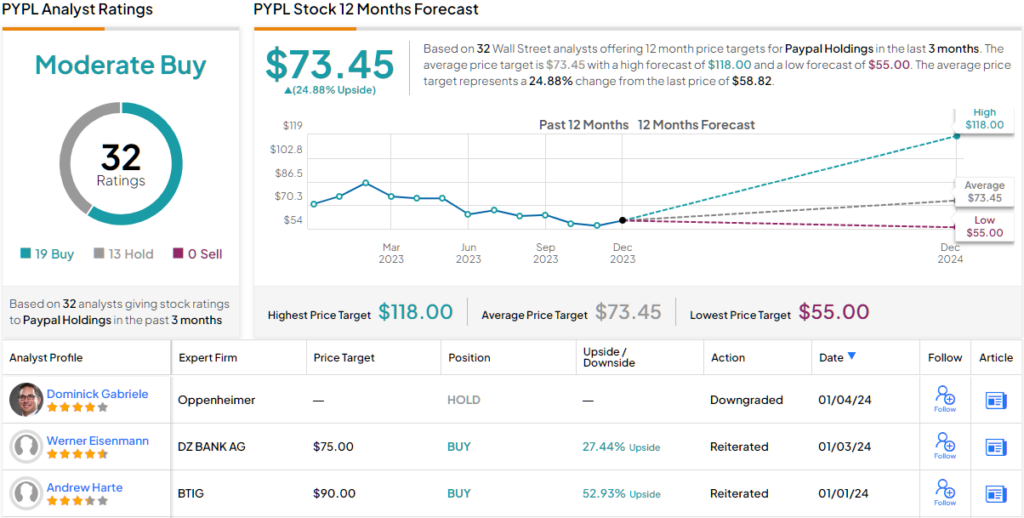

Accordingly, Gabriele downgraded his PYPL rating from Outperform (i.e., Buy) to Perform (i.e., Neutral) with no fixed price target in mind. (To watch Gabriele’s track record, click here)

Gabriele’s main problem with PayPal revolves around its profitability profile. “With Braintree 3Q23 volume growing ~32% YoY and likely to remain in the mid- to high 20s medium term, nearly any non-transaction expense growth makes increasing operating margins difficult,” says the analyst.

More specifically, with a projected gross take rate of approximately 1.5%, the business that is expanding by 32% (Braintree) is outperforming a branded business with a gross take rate of around 2.30%, which is experiencing growth of approximately 7-8% and over time, such a mix is still “likely to pressure profitability.” As such, while the shift in volume mix from branded to unbranded continues and profitability declines, over the near-term, Gabriele does not see significant expansion for PayPal’s price-to-earnings (P/E) multiple.

While the PPCP (PayPal Commerce Platform) offering is designed to generate bigger profit margins and act as a counterbalance to the growing unbranded volume mix, Gabriele says it will take years to meaningfully affect the company’s “profitability trajectory.”

And given new CEO Alex Chriss only took hold of the reins in September, Gabriele sees “better opportunity in medium-term value creation with limited transition headaches and better downside EPS protection at peers.”

Considering the persistent challenges to “structural profitability” that result in slower growth in operating income compared to volumes, and taking into account his projections for consumer spending, Gabriele views the upside/downside risks as “balanced.”

So, that’s Oppenheimer’s view, what does the rest of the Street think lies in store for PayPal? 12 others join him on the sidelines, yet with an additional 19 Buys, the stock claims a Moderate Buy consensus rating. Most project some upside, too; going by the $73.45 average target, a year from now, shares will be changing hands for ~25% premium. (See PayPal stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.