PayPal (PYPL) is enhancing the online shopping experience for both merchants and consumers with the nationwide rollout of Fastlane, its one-click guest checkout solution. After successful testing with select businesses, Fastlane is now available to all U.S. merchants.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to PayPal, Fastlane eliminates the need for manual form filling and fastens the checkout process by 32%. Furthermore, the company claims that guest checkout conversions improved by 80% during the testing phase.

However, PayPal is encountering competition in the one-click checkout solution market, with companies like Stripe Link, Checkout.com, OurPass, and Deuna offering similar services. As a result, PYPL aims to expand Fastlane to additional regions after its initial U.S. launch.

Strong Earnings and Positive Outlook

The Fastlane expansion came on the heels of PayPal’s strong second-quarter earnings report. Further, PYPL’s transaction margin, a crucial measure of payment processing profitability, climbed 8% to $3.6 billion, marking its best performance in three years.

Additionally, PayPal raised its financial outlook. For the full year, it expects adjusted earnings to surge by a low to mid-teen percent, surpassing its previous forecast of a mid-to-high single-digit increase.

What Is PayPal’s Price Target?

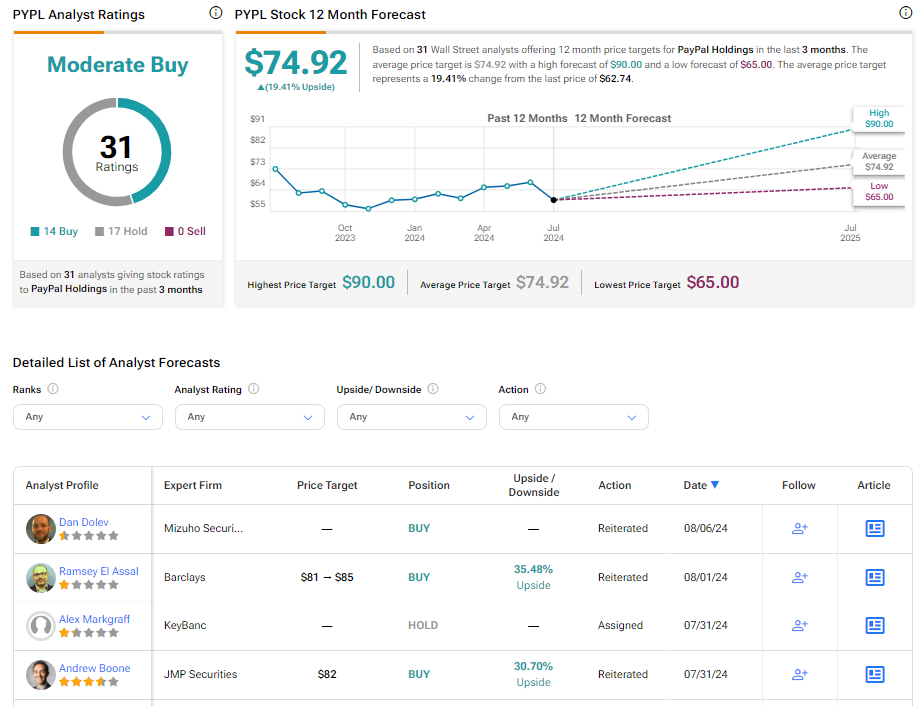

Overall, Wall Street analysts are cautiously optimistic about PYPL’s prospects. PYPL is a Moderate Buy based on 14 Buy and 17 Hold recommendations. The analysts’ average price target on PayPal stock of $74.92 implies 19.41% upside potential from current levels. Year-to-date, the stock has gained 2.2%.