Paycom Software (NYSE:PAYC) shares tanked over 32% in yesterday’s extended trading session following the release of mixed third-quarter results. The share price decline can be attributed to the weaker-than-expected guidance provided by the company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Paycom provides cloud-based human capital management software, offering businesses innovative solutions for HR, payroll, and workforce management.

The company’s adjusted earnings stood at $1.77 per share, up 39% from the same quarter last year. Further, the figure topped the analysts’ expectations of $1.61 per share. Meanwhile, Paycom reported Q3 revenues of $406.3 million, up 21.6% year-over-year, but missed the consensus estimate of $411.2 million.

PAYC’s Lower-Than-Expected Outlook

Looking ahead, PAYC anticipates fourth-quarter revenues between $420 million and $425 million, compared with analysts’ expectations of $452 million. Further, Paycom’s adjusted earnings before interest, taxes, depreciation, and amortization guidance of $169 million to $174 million remained below the consensus of $189 million.

Further, the company provided a 2024 revenue growth target of 10-12% year-over-year, which remained much below the Street’s estimate of 21%.

Analysts’ Take

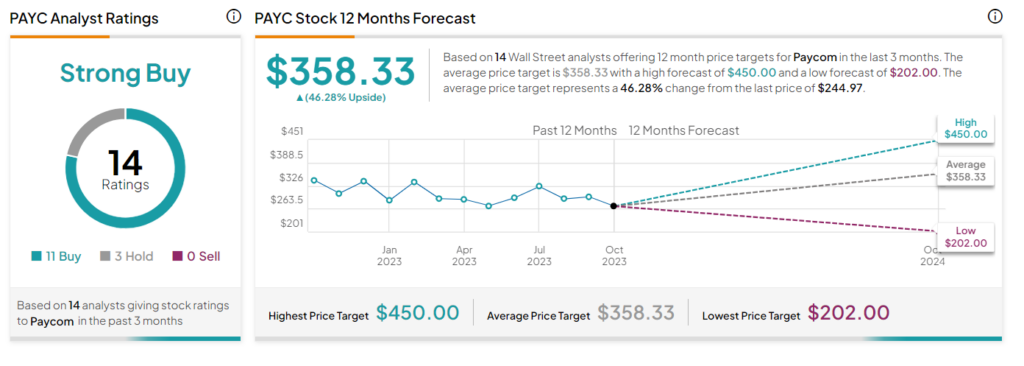

Following the Q3 earnings release, Jefferies analyst Samad Samana rated the stock a Buy. Another analyst, Bryan Bergin from TD Cowen, downgraded Paycom’s rating to Hold. He prefers to remain on the sidelines due to increased uncertainty about the company’s future prospects.

Bergin expects PAYC shares to remain rangebound as investors await more information about the company’s long-term growth.

Is PAYC a Good Buy?

On TipRanks, Paycom stock has a Strong Buy consensus rating based on 11 Buys and three Holds. The average stock price target of $358.33 implies a 46.3% upside potential. The stock is down more than 19% so far in 2023.