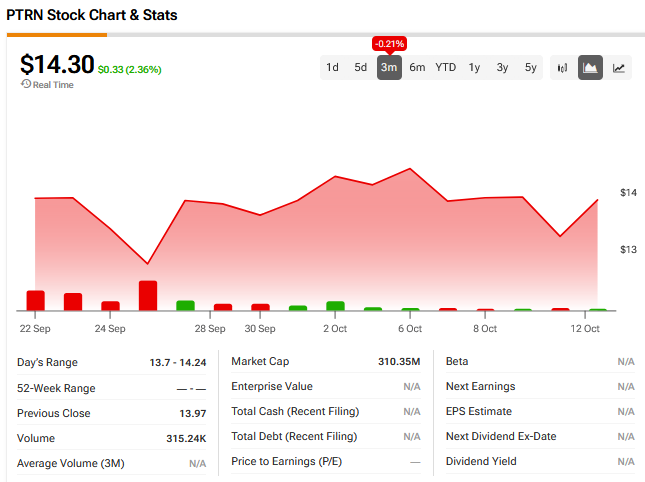

Shares in ecommerce group Pattern (PTRN) were higher today as a leading analyst said it had “substantial revenue runway.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ecommerce Accelerator

Ralph Schackart, analyst at William Blair, initiated his coverage of Pattern with an Outperform rating and a price target of $13.32.

He said the group, which listed last month, had plenty of room to grow in the ecommerce market, which has a total addressable market for retail goods of nearly $4.2 trillion. The market is forecast to grow at a compound annual rate of 9.5% from 2025 through 2029.

Founded as iServe in 2013 by David Wright and Melanie Alder, Pattern is an ecommerce accelerator that helps brands grow faster across hundreds of global marketplaces such as Amazon (AMZN), Walmart (WMT), Target (TGT), eBay (EBAY), TikTok Shop and Mercado Libre.

It says it does this by using its own technology and sophisticated machine learning and AI models.

Pattern had net income of $47 million in the six months ended June 30 on revenue of $1.14 billion, compared with net income of $35 million on revenue of $841 million a year earlier.

Valuation Gap

According to Schackart, Pattern possesses over 46 trillion e-commerce data points that its large language models (LLMs) leverage to derive insights for brand partners. Data and solutions can involve almost anything related to ecommerce, such as organic rankings, competitors, product pipelines, or shipping costs.

With over 200 brand partners, he said that Pattern has plenty of inventory, locations, and information to support smaller brands’ growth.

“Competitors are trading, on a weighted average, at 24.3 and 18.9 times EV/EBITDA based on 2025 and 2026 estimates, respectively,” he added. “Pattern is trading at a discount of 30%-35% to the comp group. We believe Pattern will be able to close this valuation gap over time.”

However, there are risks to this forecast such as too much reliance on revenues from Amazon.

Is PTRN a Good Stock to Buy Now?

As there are so few analysts covering Pattern stock let’s look at how its share price is faring.