Palantir (PLTR) took traders on a thrill ride this month—rocketing to $27.50 on AI excitement and military wins, only to slam the brakes days later. The hype came in hot, but now investors are asking if the AI hype was already baked in.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The momentum kicked off after Palantir crushed Q1 earnings. Revenue hit $634 million, up 21% year over year, while adjusted income landed at $105 million. CEO Alex Karp said it plainly on the earnings call: “The demand for our platforms is unlike anything we’ve seen in the last 20 years.” That sent shares flying 8% overnight.

Palantir Gains after Earnings and Major U.S. Army Win

But the real catalyst wasn’t just numbers—it was contracts. Palantir recently secured a $178 million U.S. Army deal tied to AI battlefield software. Investors saw it as validation that Palantir’s government muscle still packs a punch in a post-Afghanistan defense landscape. That optimism helped push PLTR over $27 for the first time since 2021.

Retail traders piled in too. In fact, Palantir became one of the most talked-about stocks on Reddit’s WallStreetBets during the second week of May.

Economic Forces Keep PLTR Price Swings Unstable

Part of the problem is timing. Investors are hunting for stable AI bets—but macro headwinds are shifting daily. Inflation pressure, rates policy, and geopolitical tensions (especially in defense procurement) make it hard for any AI-driven name to keep climbing uninterrupted.

Palantir’s value is also uniquely tied to government contracts. That means its performance can be feast-or-famine depending on how quickly agencies move on procurement.

So while Palantir has momentum, sustained gains may require a stronger mix of recurring commercial growth and improved margin clarity.

Is Palantir a Good Stock to Invest In?

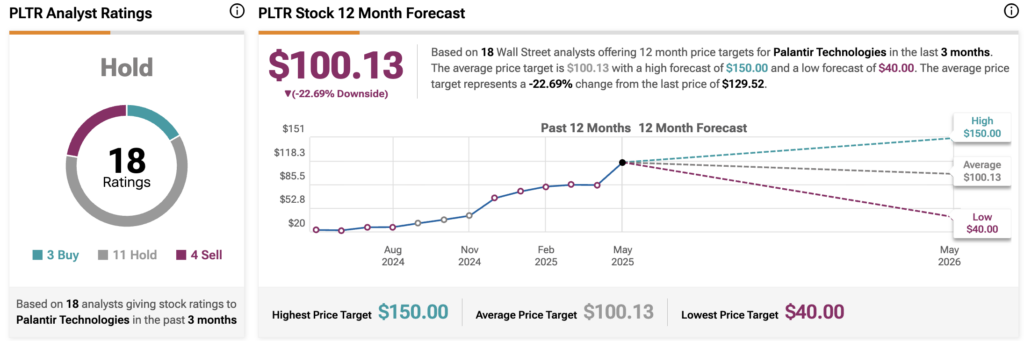

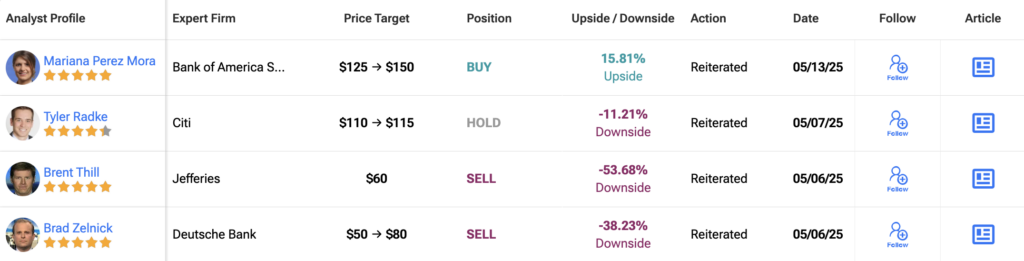

According to TipRanks, Palantir carries a Hold rating based on 18 analyst reviews. It’s a mixed bag. Just three analysts call it a Buy, 11 say Hold, and four have slapped on a Sell. That paints a picture of a stock that’s divisive even after all the AI hype.

The average 12-month PLTR price target sits at $100.13, which actually implies a 22.7% drop from Friday’s $129.52 close. The most bullish analyst sees Palantir climbing to $150. But on the flip side, the lowest forecast is just $40—a staggering 69% downside from current levels.

And those numbers track with what we’ve seen over the past few weeks. Shares have spiked on optimism, only to slide as valuation fears and macro risks creep back in. The sentiment tug-of-war here is clear: bulls see long-term government and AI contracts driving sustained growth. But bears say that future is already priced in—and then some.