Data analytics company Palantir Technologies (PLTR) has struck a deal with Boeing (BA) to accelerate the adoption of artificial intelligence (AI) across the Boeing Defense, Space & Security (BDS) unit’s factories and programs. Palantir has been growing rapidly through strategic deals across its commercial and government businesses.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Palantir to Help Boeing Leverage AI

Under the deal, BDS will use Palantir’s Foundry platform, which leverages AI to integrate complex systems under a streamlined and intuitive user interface. The partnership with Palantir will enable Boeing’s BDS unit to standardize data analytics and insights across its geographically diverse defense factories.

“Palantir is on the cutting edge when it comes to leveraging Artificial Intelligence to accelerate getting critical products, services, and capabilities in the hands of military operators,” said Steve Parker, CEO, BDS.

Palantir will also provide AI expertise and capabilities to BDS on several undisclosed classified and proprietary initiatives focused on supporting military clients’ most sensitive missions.

PLTR Stock Continues to Rally

Palantir stock continues to rise even as several analysts have cautioned about its lofty valuation. PLTR stock has advanced 15% over the past month and has rallied 141.4% year-to-date. The company continues to impress investors with its strong financial performance. Palantir delivered upbeat Q2 results, with its quarterly revenue crossing the $1 billion mark for the first time. Moreover, the company raised its full-year guidance, backed by the demand for its AI offerings.

Last week, Palantir announced a key deal with the UK, under which the company has agreed to invest up to £1.5 billion to help the UK military develop the latest digital tools and leverage AI technology.

Yesterday, a top Bank of America analyst assigned a Street-high price target to PLTR stock, citing robust growth across the company’s data analytics applications and strength in its government business.

Is PLTR a Good Stock to Buy Now?

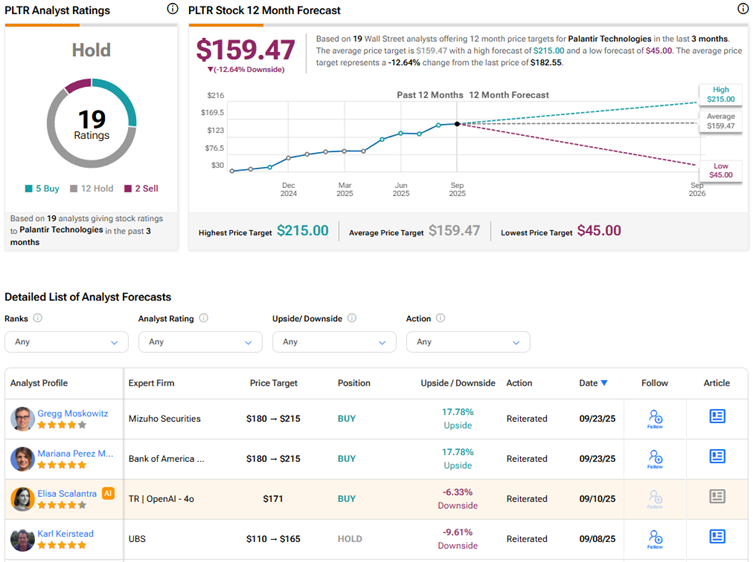

Currently, Wall Street is sidelined on Palantir Technologies stock, with a Hold consensus rating based on five Buys, 12 Holds, and two Sell recommendations. The average PLTR stock price target of $159.47 indicates a possible downside of 12.6% from current levels.