On Tuesday, top Bank of America analyst Mariana Perez Mora reiterated a Buy rating on Palantir Technologies (PLTR) stock and raised the price target from $180 to a Street-high of $215, indicating about 18% upside potential. Following a meeting with Akshay Krishnaswamy, the company’s Chief Architect, the 5-star analyst boosted the price target to reflect stronger growth across the company’s data analytics applications. In particular, Mora highlighted the strength in PLTR’s government business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

PLTR stock has rallied more than 141% year-to-date, driven by the company’s solid financial performance and robust demand for its AI-powered offerings.

Top Bank of America Analyst Is Bullish on PLTR Stock

Following the AIPCon 8 event, Mora highlighted that the Ontology architecture and the forward-deployed engineers’ (FDEs) go-to-market strategy continue to be Palantir’s “secret sauce.” The analyst’s meeting with Krishnaswamy last week focused on the role of the FDEs and how the company is already capitalizing on its Agentic AI capabilities to extend this “idiosyncratic skillset” to more use cases.

Mora noted that the award from the UK’s Ministry of Defense (MOD) builds on Palantir’s momentum as the global digital battle-management system. The 5-year-long award, which is worth up to £750 million, marks Palantir’s first billion-dollar contract (in U.S. dollars over the duration of the award) outside the U.S. and builds on the company’s existing UK exposure (National Health Service and MOD) and growing international demand among U.S. allies.

The top-rated analyst noted that Palantir’s Maven Smart System continues to grow in the U.S. (8x since early 2024) and was selected in April by NATO to enhance intelligence, target recognition, battlespace awareness, and decision-making capabilities for warfighters. Mora expects other countries to increasingly consider Maven as their global digital battle-management system, given its interoperability with the U.S. and allies as well as governance of their own data. Mora now expects Palantir’s government sales to exceed $8 billion by 2030, indicating a 30% estimated compound annual growth rate (CAGR) over the 2025 to 2030 period.

Is Palantir a Good Stock to Buy?

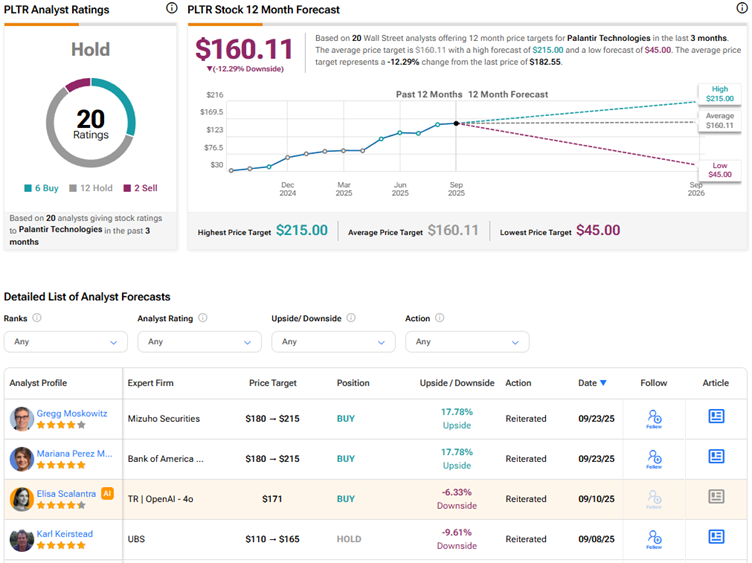

Currently, many analysts are sidelined on Palantir Technologies stock, mainly due to its elevated valuation. Wall Street’s Hold consensus rating on PLTR stock is based on 12 Holds, six Buys, and two Sell recommendations. The average PLTR stock price target of $160.11 indicates a possible downside of 12.3% from current levels.