Shares of Palantir (NYSE:PLTR) tumbled at the time of writing after analysts weighed in on the firm’s Q2 results. Indeed, the financial world seems split on Palantir’s trajectory. Morgan Stanley’s Keith Weiss threw a splash of cold water on the optimism around AI, citing concerns about revenue growth and the company’s future projections. He believes the stock needs a solid nudge in revenue growth, but current fundamentals make that look distant.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

On the flip side, the mood’s more upbeat elsewhere. Bank of America remains bullish, especially after catching wind of the AIP platform and Palantir’s anticipated profitability. Meanwhile, Wedbush Securities’ Dan Ives is singing Palantir’s praises, seeing the recent quarter as merely a step towards a glittering future. According to Ives, Palantir is geared to ride the wave of commercial spending in the coming months and beyond into 2024.

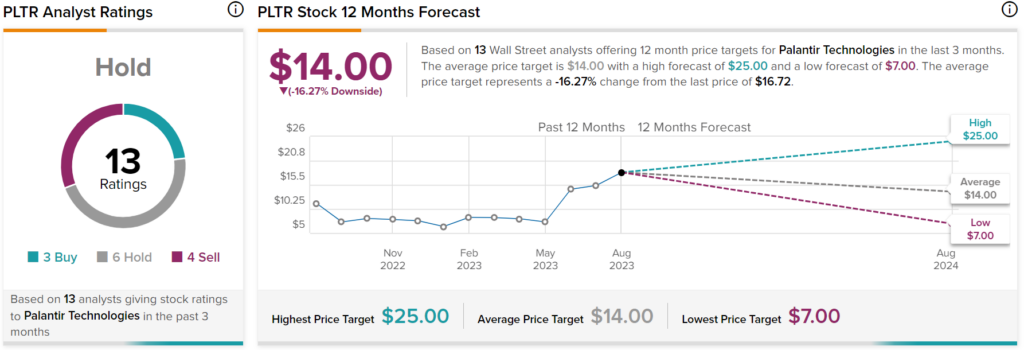

Overall, analysts have a Hold consensus rating on PLTR stock based on three Buys, six Holds, and four Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $14 per share implies 16.27% downside risk.