Shares of Palantir (NYSE:PLTR) gained in after-hours trading after the company reported earnings for its second quarter of Fiscal Year 2023. Earnings per share came in at $0.05, which was in line with analysts’ consensus estimates. Sales increased by 12.8% year-over-year, with revenue hitting $533.32 million. This was also in line with expectations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Commercial revenue saw an impressive year-over-year increase of 10%, reaching $232 million, with the U.S. commercial sector particularly standing out with a 20% growth, accumulating $103 million. On the government side, revenue escalated by 15% from the previous year, amounting to $302 million, and the surge was even more pronounced internationally, with a 31% growth bringing in $76 million. In terms of clientele, there was a notable 38% year-over-year growth, alongside an 8% rise from the last quarter. Specifically, the U.S. commercial customer count climbed by 35% in a year, moving from 119 customers in Q2 2022 to 161 customers by Q2 2023.

Looking forward, management now expects revenue and adjusted income from operations for Q3 2023 to be in the ranges of $553 million to $557 million and $135 million to $139 million, respectively. For reference, analysts were expecting $555.9 million in revenue.

What is the Prediction for PLTR Stock?

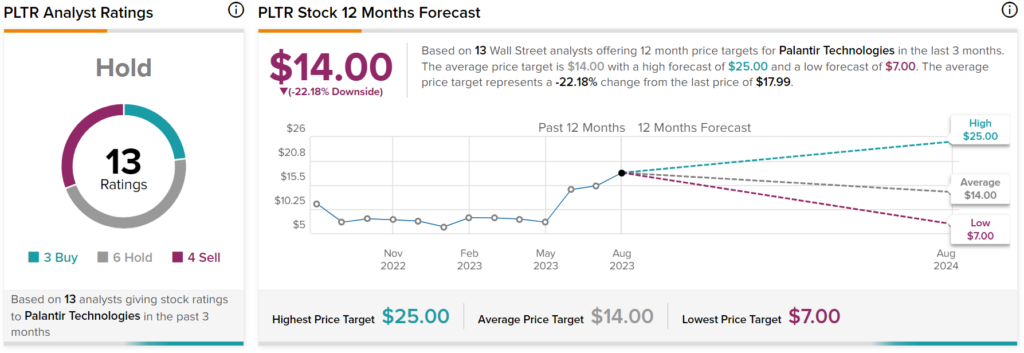

Overall, Wall Street has a consensus price target of $14 on PLTR stock, implying 22.18% downside risk, as indicated by the graphic above.