In the 1990s, the sudden rise of the internet changed forever the ways in which we view technology, social interaction, and the economy. The dot-com bubble of 1995 to 2000 grew on a ‘get rich quick’ mentality that pulled investors and money into something new – a tech sector like no one had seen before.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The bubble burst by 2002, but it left a mark. Surviving tech firms were stronger, and investors were a little bit wiser. The tech sector quickly became one of the stock market’s major growth engines.

Today, AI technology is turning into the big market play, changing the tech world in ways comparable to the ’90s bubble. From the ways in which we search online, to the ways in which we control data management and analysis, to the advent of autonomous technologies, AI is at the root of tech’s cutting edge.

Watching this situation from Wedbush, Daniel Ives, a 5-star analyst rated in the top 4% of the Street’s stock pros, is taking the measure of AI stocks: “This is a 1995 Moment as now the AI Revolution and $1 trillion of incremental spending over the next decade is hitting the software ecosystem and the rest of the tech sector… This is a transformational tech trend we have not seen since the start of the internet in the mid-90s… For the elite, transformational tech stories… AI Revolution investors must see the forest through the trees to where this spending wave (and estimates) can head over the next 3 years, and we believe 60%-70% of enterprises will ultimately head down the AI use case path.”

Against this backdrop, Ives singles out Palantir (NYSE:PLTR) and Microsoft (NASDAQ:MSFT) as prime investment opportunities within the AI sector. Do other analysts agree? We used the TipRanks database to find out. Let’s take a closer look.

Palantir

First up is Palantir, named for the magical seeing stones in J.R.R. Tolkien’s Lord of the Rings. In the books, the stones let the holder see important events across space and time; the modern tech firm, co-founded in 2003 by venture capitalist Peter Thiel, uses AI-powered software platforms and advanced data analytics to give customers a clearer picture of current events in real-time.

Put into practical terms, Palantir is using AI systems to augment human intelligence. The company’s AI platforms allow users to interact with the computer via natural language, asking complex questions and getting nuanced answers – and avoiding the need for using detailed statistical models or computer coding scripts and languages.

Palantir does not offer this service as a one-size-fits-all; rather, customers can choose from a wide set of platforms that are optimized for various purposes, including private control of an AI network; managing real-time connectivity between data, analytic, and operational systems; and accelerating decision-making processes. The company’s platforms can impact a near-endless list of fields, from anti-money laundering to data protection to telecom and system utilities.

In the two decades since its founding, the company has expanded into a $50 billion giant of the software industry and, in recent months, has leveraged its mastery of AI. In the last reported quarter, for 4Q23, the company’s total revenue amounted to $608.35 million, marking a year-over-year gain of nearly 20% and surpassing the forecast by $5.55 million. At the bottom line, Palantir’s non-GAAP EPS figure came to 8 cents per share, in line with the estimates and the sixth non-GAAP profit in a row.

The stock has been outperforming the broader market by a wide margin lately, with a share appreciation of 196% in the last 12 months and 38% for the year-to-date.

Daniel Ives, in his coverage of Palantir, emphasizes the company’s outsized success and rapid growth, writing: “A handful of times every decade there are tech companies that are so ahead of the competition and in a sweet spot of the future growth… yet the Street at the time dismisses it by dusting off their long term stubborn bear thesis and 30 spreadsheets… [Palantir] went from an off Broadway play to a primetime Broadway theater right off of Times Square under the bright lights. With a US commercial business that grew an eye popping 70% in 4Q (up from mid 20% a few quarters ago) and commercial customer count that grew 44% as the AI Revolution is driving AIP deal flow to a level we did not expect until 2025.”

Looking ahead, Ives suggests PLTR stock could bring further returns to investors, noting, “As the commercial business ramps at this massive pace, FCF could approach $1 billion in 2024 with this margin/cash flow story just beginning. We also believe inclusion to the S&P 500 is on the near-term horizon given this pace of profitability. In a nutshell, PLTR remains an undiscovered gem and a core part of our thesis in the AI Revolution just now taking shape across the tech world.”

Taken together, these comments back up Ives’ Outperform (i.e. Buy) rating on the stock, while his price target of $30 points toward a 12-month upside of more than 26%. (To watch Ives’ track record, click here)

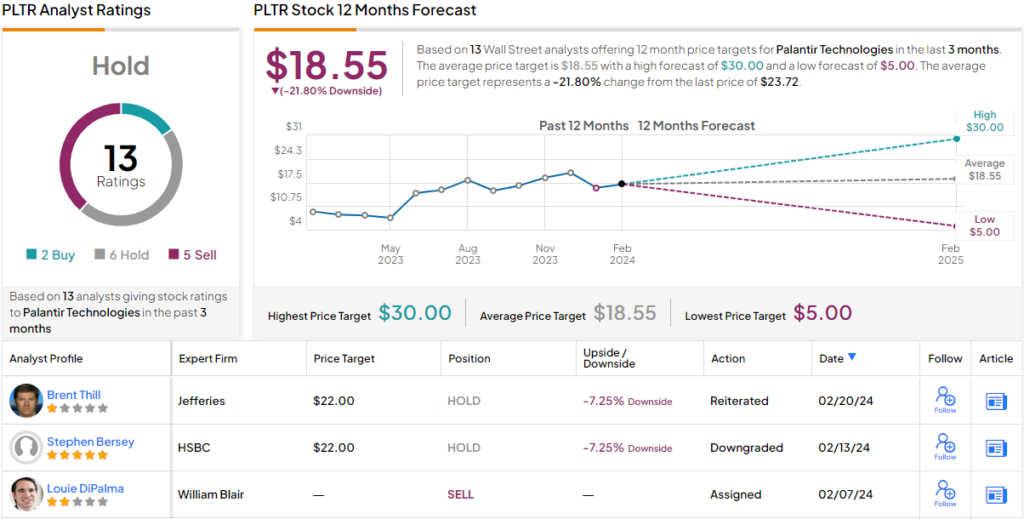

That’s the bullish view. The overall view from the Street is more cautious on Palantir; the stock has a Hold consensus rating, based on 13 recent analyst reviews that include 2 Buy ratings, 6 Holds, and 5 Sells. The shares have an average price target of $18.55, which implies shares will remain rangebound for the foreseeable future. (See Palantir stock forecast)

Microsoft (MSFT)

Next up is one of the truly iconic names in software, Microsoft. This company was ‘present at the creation;’ it has been in the computing business since 1975, and has been developing software and systems for personal computers since the heady years of the PC’s inception.

Early entry into the field does not guarantee long-term success. Microsoft cemented that with its Windows operating system, which has become the industry standard, and with its Office software package, which has become the must-have software in workplaces around the world. These have propelled the company into the leading position it occupies in the computing industry, and today the company can boast of being the world’s largest publicly traded corporation, with a market cap of $3.05 trillion.

Like many other smart companies, Microsoft hasn’t rested on the laurels of its widely used and hugely successful flagship products. The company has been expanding its expertise and moving into new areas of the computing industry. In particular, Microsoft has made strong advances in both cloud computing and AI technology.

On the cloud side, Microsoft’s Azure platform has become another addition to the company’s list of essential business software solutions. The Azure cloud platform hosts more than 200 software products, and subscribers can pick and choose from the tools and services they need most. In recent quarters, Azure has been a powerful driver of Microsoft’s revenues.

On the AI side, Microsoft is both an early adopter and is currently jumping in with both feet. The company has long been a backer of OpenAI, the tech firm whose ChatGPT program set off the current boom in generative AI just 16 months ago. In addition, Microsoft is launching AI tools of its own, integrating them into its Azure platform – and developing a generative AI personal assistant app, called Copilot.

Turning to finances, we find that Microsoft’s last reported quarter, for fiscal 2Q24, saw beats at both the top and bottom lines. The company’s fiscal Q2 revenue, of $62 billion, was $890 million better than had been forecast – and was up nearly 18% from the prior year. On the bottom line, the EPS, at $2.93 according to GAAP measures, was 16 cents per share better than the estimates.

Microsoft’s results found support in the company’s Intelligent Cloud division, which includes Azure, and which saw a 20% year-over-year jump to $25.9 billion, and came in a solid half-billion more than what had been anticipated. Azure alone was up 30% year over year.

Ives likes Microsoft, and he’s upbeat after the company’s strong earnings release last month. Specifically, he sees the company’s ongoing build-up of AI tech as a net positive for the long term.

“Microsoft delivered its FY2Q24 results that featured top and bottom-line beats as the company continues investing heavily into integrating AI into its overall portfolio to accelerate growth while focusing intently on bottom-line expansion. This was another masterpiece quarter and guidance from Nadella that will send a major ripple impact across the tech world tomorrow as the AI Revolution is here… We believe this is the start of a multi-year initiative aimed at generating significant AI use cases for customers across the enterprise landscape to gain further efficiencies while accelerating profitable growth with Redmond leading the charge in this potential $1 trillion opportunity,” Ives opined.

This top analyst goes on to give MSFT shares an Outperform (i.e. Buy) rating, and sets a $450 price target that implies a 10% gain in store for the coming year. (To watch Ives’ track record, click here)

The Magnificent 7 stocks get no lack of analyst attention, and MSFT has picked up no fewer than 35 analyst reviews in recent weeks. These break down to a lopsided 33 Buys, 1Hold, and 1 Sell – for a Strong Buy consensus rating on the shares. The current trading price is $408.54, and the average target price of $469.58 is slightly more bullish than Ives’, suggesting a one-year upside potential of 15%. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.