Shares of bank holding company PacWest Bancorp (NASDAQ:PACW) are nosediving today after the company pledged a further $5.1 billion of its loans with the Federal Reserve Bank (FRB) for an additional borrowing capacity of $3.9 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The pledging of loans under the discount window borrowing facility now takes immediately available liquidity for PacWest to $15 billion. Furthermore, PacWest has seen a drop of 9.5% in deposits during the week ending May 5.

Today’s price decline comes fresh after a short-lived rally in regional bank stocks earlier this week even as challenges in the banking sector continue to persist.

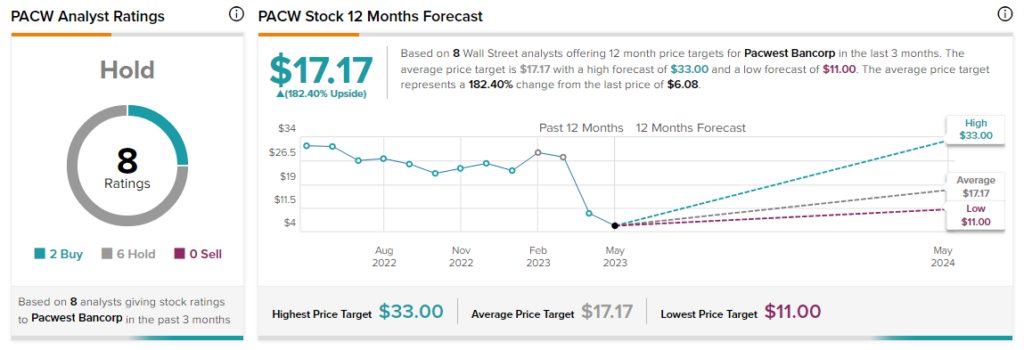

Overall, the Street has a $17.17 consensus price target on PacWest alongside a Hold consensus rating. Shares of the company are down nearly 29% at the time of publishing today while short interest in the stock still remains at nearly 17%.

Other banking names including Western Alliance Bancorp (WAL), Comerica (CMA), and Zions Bancorp. (ZION) were mixed at the time of writing

Read full Disclosure