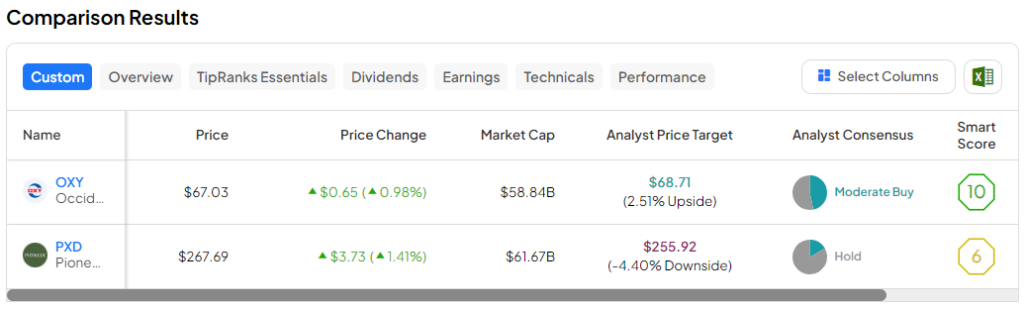

In this piece, I evaluated two energy stocks, Occidental Petroleum (NYSE:OXY) and Pioneer Natural Resources (NYSE:PXD), using TipRanks’ comparison tool (see the image below) to see which stock is better. A closer look suggests a bearish view for Occidental and a neutral view for Pioneer.

Occidental Petroleum and Pioneer Natural Resources both engage in the exploration and production of oil and natural gas. Shares of Occidental Petroleum are up 12.6% year-to-date and 4% over the last year, while Pioneer Natural Resources stock is up 20.5% year-to-date, soaring 31.9% over the last 12 months.

With such a dramatic difference in their year-to-date performances, the significant gap in their valuations is unsurprising. However, Exxon Mobil’s (NYSE:XOM) pending acquisition of Pioneer sets a ceiling on the company’s stock price at around $253 a share, or roughly 2.3 times Exxon’s price (more on this below).

Occidental Petroleum (NYSE:OXY)

At a price-to-earnings (P/E) ratio of 16.6x, Occidental Petroleum is trading at a premium to its industry’s P/E of 10.6x. Additionally, the risks associated with this company can’t be ignored, so a bearish view seems appropriate, especially considering its price-to-book (P/B) ratio of around 2.6x.

Occidental Petroleum has received lots of attention since Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) started loading up on shares, reaching a 28% stake in the company as of the end of 2023. In his annual letter for 2023, Buffett said he likes the company’s “vast oil and gas holdings” in the U.S. and its “leadership in carbon-capture initiatives.”

However, a closer look at the company’s financials and balance sheet gives pause. While it is common for energy companies to carry significant debt, Occidental has a habit of repeatedly taking on large amounts of debt to make new acquisitions.

In 2023, the company’s total revenue dropped 23% year-over-year to $28.3 billion, while its net debt remained at $19.5 billion, albeit down slightly from $19.8 billion in 2022. Additionally, Occidental announced another acquisition in December: CrownRock — a Permian producer.

The company is again using mostly debt to fund that $12 billion acquisition, further increasing its net debt. As a point of comparison, energy behemoth Exxon Mobil had only $16.2 billion in net debt with $334.7 billion in revenue for 2023.

Then, in its fourth-quarter earnings release, Occidental announced that it was cutting production at two shale rigs in the Permian basin to reduce costs. Meanwhile, its total oil and gas sales fell 13.9%, and its chemical sales fell 16.4% in the quarter.

When combined, these just aren’t good trends, and they could signal trouble for Occidental down the road. In fact, short-sellers seem to agree, as short interest in the company has been hovering in the 5%-to-6% range for some time, making it one of the most-shorted energy stocks in the S&P 500 (SPX).

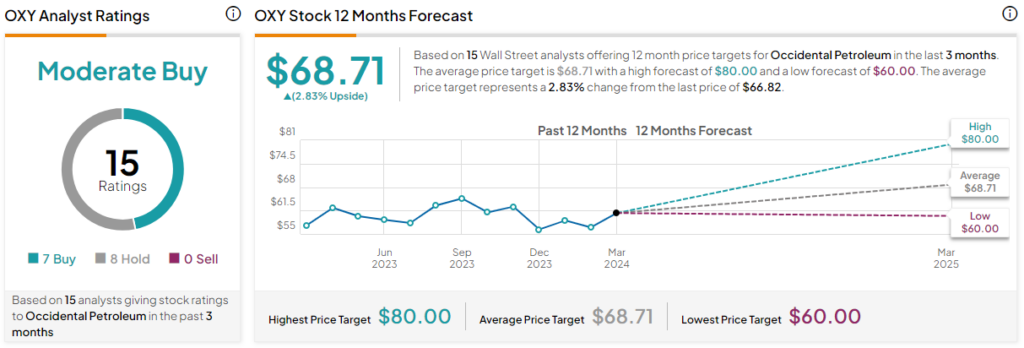

What Is the Price Target for OXY Stock?

Occidental Petroleum has a Moderate Buy consensus rating based on seven Buys, eight Holds, and zero Sell ratings assigned over the last three months. At $68.71, the average Occidental Petroleum Stock price target implies upside potential of 2.8%.

Pioneer Natural Resources (NYSE:PXD)

At a P/E of 12.7x and an EV/EBITDA ratio of around 7x, Pioneer Natural Resources is trading at a premium to its industry on both measures. However, what’s most important for the company right now is Exxon Mobil’s planned acquisition of the company. Thus, a neutral view seems appropriate.

The two companies expect the acquisition to close in the second quarter, so we’re basically in a holding pattern here. Of course, regulators are scrutinizing the deal, but that’s to be expected. Notably, it’s an all-stock deal, with Pioneer shareholders receiving 2.3234 shares of Exxon for every Pioneer share they own, making this a highly attractive offer for current Pioneer shareholders.

Unfortunately, shareholders who don’t already own Pioneer may have missed the boat on locking in a deal on this backdoor opportunity into Exxon Mobil stock. However, the stock may be worth monitoring just in case a sizable disconnect between the valuations of Pioneer and Exxon shares develops. Additionally, any updates on the pending acquisition could trigger a change in the share prices.

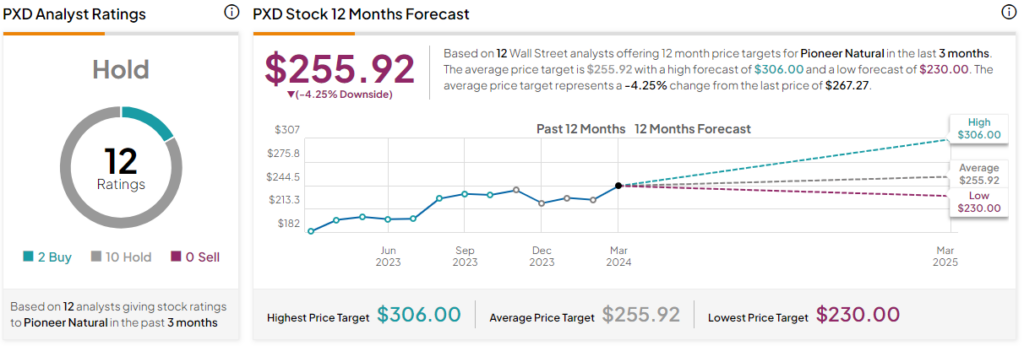

What Is the Price Target for PXD Stock?

Pioneer Natural Resources has a Hold consensus rating based on two Buys, 10 Holds, and zero Sell ratings assigned over the last three months. At $255.92, the average Pioneer Natural Resources stock price target implies downside potential of 4.25%.

Conclusion: Bearish on OXY, Neutral on PXD

Occidental Petroleum has received lots of attention due to Buffett’s sizable stake in the company, but at the current share price and with the company’s latest sales numbers falling, there’s too much risk to be bullish on the stock.

Meanwhile, I am neutral on Pioneer Natural Resources due to the Exxon acquisition. In fact, shareholders may be better off buying Exxon shares directly rather than buying Pioneer stock at current prices, although this could change as the companies’ stock prices change or if there is any news on the pending acquisition.