President Trump is threatening to pull the plug on an additional $12 billion in clean energy project funds as he moves the U.S. away from green fuel and back to oil and gas.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The sum will be on top of the $8 billion cut in funding for innovative energy projects, such as carbon capture, announced last week.

Off With Their Heads

The latest cull, according to an article in Reuters, has been dubbed the “kill list.” Quite an apt description for an administration which has no time for renewable energy projects – describing wind turbines as windmills – climate change science or previous President Biden’s embrace of green energy.

It has, since the first day of Trump’s return to office in January, been advocates of a fossil fuel first policy dubbed, “Drill, Baby, Drill.”

The kill list includes major carbon removal and clean hydrogen efforts that had been approved by the Department of Energy under the Biden administration.

So, which companies’ projects are heading to the Guillotine?

Occidental

One of the projects set to be ditched is the South Texas Direct Air Capture Hub, a facility that Occidental Petroleum’s (OXY) 1PointFive subsidiary planned to develop in Kleberg County, Texas.

Direct Air Capture (DAC) pulls CO₂ directly from the atmosphere, which can then be stored underground or reused. The proposed plant would have pulled 500,000 tonnes of CO₂ from the air every year to combat global warming.

The original government support for this project would have led to $500 million or more being given in total grants as it developed over time. Occidental shares were up slightly in pre-market trading.

General Motors

General Motors (GM) was awarded $500 million last year to convert its Lansing Grand River Assembly Plant in Michigan to EVs. The grant came from a federal Domestic Manufacturing Conversion Grant program. These grants aimed to support U.S. production of efficient hybrid, plug-in electric hybrid, plug-in electric, and hydrogen fuel cell electric vehicles. GM had described the move as underscoring its “commitment to U.S. manufacturing leadership.”

A theme, which President Trump has been equally as enthusiastic about and one of the fundamental reasons behind his tariff hikes. GM shares were flat in pre-market trading.

Stellantis/Samsung

Fellow car maker Stellantis (STLA) has two projects on the block. A $335 million grant to convert the shuttered Belvidere Assembly plant in Illinois to build mid-size electric trucks, and $250 million to convert its Indiana Transmission Plant in Kokomo to a gigafactory producing EV batteries. It was part of the StarPlus energy joint venture between Stellantis and electronics group Samsung (SSNLF). Stellantis shares were 0.6% higher in pre-market trading.

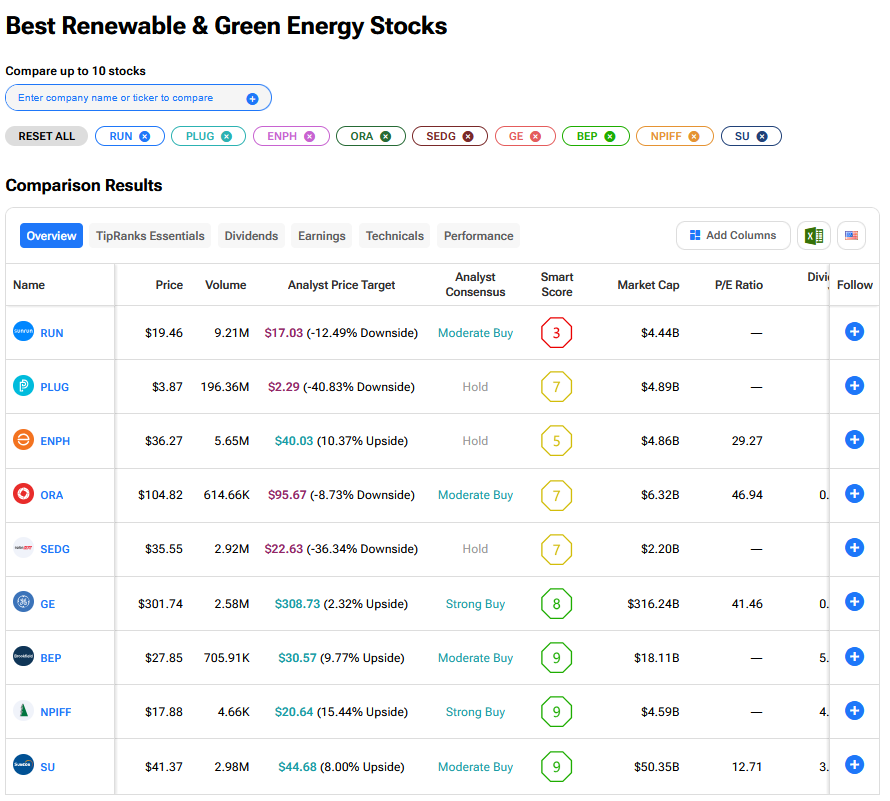

What are the Best Green Energy Stocks to Buy Now?

We have rounded up the best green energy stocks to buy now using our TipRanks comparison tool.