Ouster (NYSE:OUST) shares jumped nearly 14% in pre-market trading today after the lidar sensors provider delivered an impressive third-quarter performance, with revenue of $22.2 million clocking a 98.3% year-over-year jump. Further, EPS of -$0.89 came in better than expectations by $0.04.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, sensor shipments rose by 10% sequentially to 3,300, and bookings came in at a healthy $38 million. Further, the combination of a favorable product mix and lower manufacturing costs helped the company improve its gross margin to 14%, compared to 1% in Q2.

Additionally, Ouster is experiencing traction in its software offerings and positive customer response for its solid-state automotive Digital Flash (DF) sensor. Next, the company aims to boost new business through targeted sales, achieve annual revenue growth in the range of 30% to 50%, and expand its gross margins to 35% to 40%.

The company achieved annualized cost savings of $120 million in the third quarter and expects revenue to be in the range of $23 million to $25 million for the upcoming quarter.

Is OUST a Good Stock to Buy?

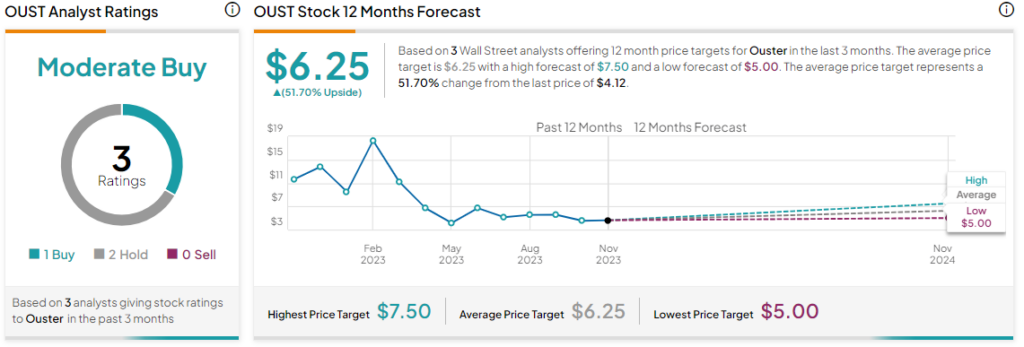

Overall, the Street has a Moderate Buy consensus rating on Ouster, and the average OUST price target of $6.25 implies a mouth-watering 51.7% potential upside. That’s after a nearly 57% slide in Ouster shares so far this year.

Read full Disclosure