O’Reilly Automotive’s (NASDAQ:ORLY) streak of good luck continues after analysts at Cowen named the stock a top pick on Tuesday. Just last week, Citi upgraded the stock from Hold to Buy and raised its 12-month price target on the stock. For Cowen, O’Reilly Automotive’s business upside and value proposition are part of the rationale behind the selection.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The firm noted that the company operates a best-in-class supply chain and offers great service. Cowen said these factors will drive long-term market share growth across the company. Cowen predicts that the auto retailer’s revenue will grow at a 6.8% CAGR between FY22 and FY26, forecasting that O’Reilly’s market share will reach 9.7% by FY26.

Is O Reilly’s a Good Stock to Buy?

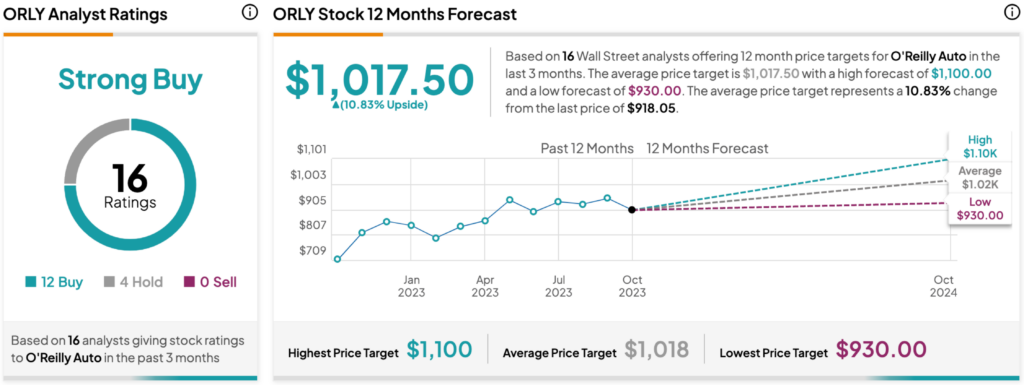

Turning to Wall Street, analysts have a Strong Buy consensus rating on ORLY stock based on 12 Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average ORLY price target of $1,017.50 per share implies 10.83% upside potential.