Oracle issued U.S. investment-grade bonds for $18 billion, making it the second-largest deal in the market this year.

Oracle Stock (ORCL) Slides as $18B Bond Sale Sparks Investor Caution

Story Highlights

Oracle Corporation (ORCL) shares dipped after the company announced plans to raise $18 billion through a new bond offering. The move is part of Oracle’s plan to support its large cloud infrastructure projects. However, investors reacted cautiously, concerned about the potential impact on the company’s debt levels and stock performance. ORCL stock fell 1.71% on Wednesday, followed by another 2.3% in pre-market hours on Thursday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

More Details About the Bond Sale

According to regulatory filings, Oracle issued U.S. investment-grade bonds for $18 billion, marking the market’s second-largest deal this year. The debt was issued in six tranches, including a rare 40-year bond.

In a separate filing, the company said proceeds from the bond sale could be used for general corporate purposes, including stock repurchases, debt repayment, and acquisitions.

Oracle Gears Up for Big Deals

Oracle has positioned itself as a key provider of computing power for companies like OpenAI. The firm has secured multi-year contracts that demand substantial upfront investment in data centers, chips, and networking infrastructure. Yesterday, the company, alongside OpenAI and SoftBank (SFTBY), announced an expansion of the Stargate project with five new sites.

Oracle is also the cloud provider for TikTok in the U.S. Under a new White House framework, it will help develop a U.S.-only version of TikTok’s algorithm.

Over the coming years, Oracle plans to spend hundreds of billions on renting and powering data centers. By raising capital through debt markets, Oracle can scale these operations quickly without tapping too deeply into cash reserves.

Why Investors Are Nervous

Investors could be nervous as Oracle’s $18 billion debt raise supports growth but also heightens near-term risk. The additional borrowing increases the company’s total liabilities, adding financial pressure.

Meanwhile, higher debt also means greater interest expenses, which could reduce short-term profits and limit cash flow flexibility. Some investors may worry that the extra debt could weigh on stock performance, especially if the funds aren’t quickly deployed to generate strong returns.

Is ORCL Stock a Buy?

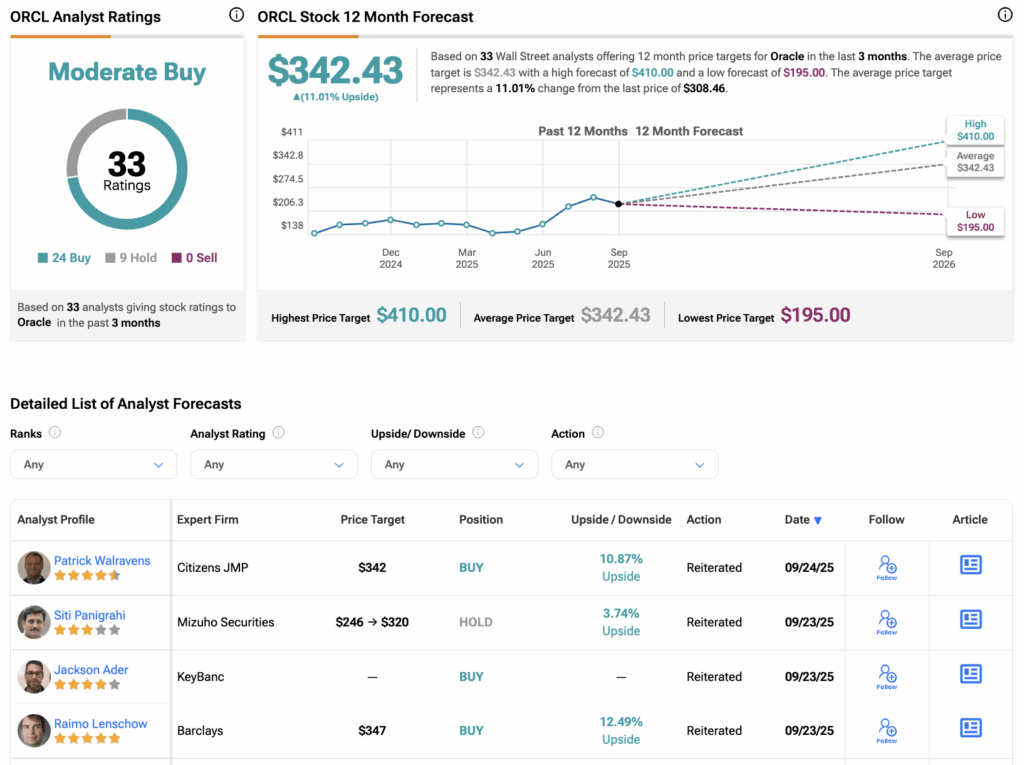

Overall, Wall Street has a Moderate Buy consensus rating on ORCL stock, based on 24 Buys and nine Holds assigned in the last three months. The average Oracle stock price target of $342.43 implies an upside of 11.01% from current levels.

Year-to-date, ORCL stock has gained 85%.

1